Tax Savings Plan: Complete Guide to Reducing Your Tax Burden in 2025

A well-designed tax savings plan can save you thousands of dollars annually while building long-term wealth. With federal income taxes consuming a significant portion of most Americans’ income, strategic tax planning has become essential for financial success. Rather than simply reacting to tax obligations each April, smart taxpayers proactively structure their finances throughout the year to minimize their tax liability.

This comprehensive guide will walk you through the essential components of an effective tax savings plan, from maximizing tax advantaged accounts to implementing sophisticated investment strategies. Whether you’re just starting your career or approaching retirement, these proven strategies can help reduce your tax burden while advancing your financial goals.

What Is a Tax Savings Plan?

A tax savings plan is a comprehensive strategy that combines tax-advantaged accounts, strategic investment choices, and precise timing decisions to minimize your lifetime tax liability. Unlike simple tax preparation, which focuses on last-minute deductions, a proper tax savings plan operates year-round to reduce your taxable income, defer taxes to more advantageous periods, and optimize your overall tax efficiency.

The foundation of any effective tax savings plan rests on three core principles. First, it maximizes contributions to retirement accounts, health savings accounts, and education savings vehicles that provide immediate tax deductions or long-term tax-free growth. Second, it strategically positions investments across different account types to minimize annual tax drag on your portfolio. Third, it coordinates the timing of income recognition, deductions, and investment transactions to keep you in lower tax brackets whenever possible.

Your tax savings plan should be tailored specifically to your income level, current tax bracket, and long-term financial goals. A young professional in the 22% federal tax bracket will benefit from different strategies than a high earner facing the 37% rate or someone approaching retirement with substantial pre-tax savings. The key is developing a coordinated approach that evolves with your changing financial situation.

Successful tax planning requires understanding how different types of income are taxed. Ordinary income from wages and interest faces the highest rates, while long-term capital gains and qualified dividends receive preferential treatment. Municipal bonds generate tax-free interest, and Roth account withdrawals aren’t subject to income tax at all. By strategically managing these different income streams, you can significantly reduce your overall tax bill.

Understanding Taxable Income

Taxable income serves as the decisive foundation of strategic tax planning—inefficient approaches here cost you significantly in federal income taxes annually. This critical figure emerges through systematic calculation: take your adjusted gross income (AGI), encompassing all income sources including wages, interest income, and capital gains, then subtract allowable tax deductions and exemptions with precision. The resulting taxable income becomes your strategic baseline for calculating tax liability based on current rates—no ambiguity, just clear financial optimization.

Mastering taxable income components is absolutely essential for identifying decisive tax reduction opportunities. Ordinary employment income, interest income from savings accounts or bonds, and capital gains from investment sales all contribute to your taxable burden—inefficiencies in managing these sources are profoundly costly. Strategic optimization requires maximizing available deductions and timing income sources with precision. Contributing to tax-advantaged accounts or strategically timing investment sales to realize long-term capital gains eliminates unnecessary exposure to higher tax rates—decisive action that delivers measurable results.

Strategic taxable income planning delivers dual benefits: reduced tax obligations and optimized investment decisions that align with long-term wealth accumulation goals. This systematic approach transforms tax complexity into clear financial advantage—the difference between reactive tax payment and proactive wealth optimization.

Understanding Tax Burden

Your tax burden represents the total financial obligation you face across federal, state, and local jurisdictions—and eliminating unnecessary portions of this burden is absolutely critical for wealth optimization. This encompasses federal income taxes, state and local levies, plus any capital gains taxes from your investment activities. Mastering your tax burden isn't just important—it's the decisive factor that separates successful wealth builders from those who surrender their earnings to inefficient tax strategies.

Reducing your tax burden demands strategic action through tax advantaged accounts like retirement vehicles and health savings accounts (HSAs), which systematically lower your taxable income while delivering tax-free or tax-deferred growth. Municipal bonds generate tax free interest income—a powerful tool for slashing your overall tax liability. Local taxes and state income taxes create significant variables depending on your geographic positioning, making location strategy non-negotiable for serious wealth optimization.

Understanding your complete tax burden and deploying proven strategies—tax-advantaged accounts, strategic deductions, and tax-free investments—transforms your financial trajectory. The goal is crystal clear: maximize what you keep, minimize what you pay, and eliminate every unnecessary tax dollar that stands between you and your wealth-building objectives.

Essential Tax-Advantaged Accounts for Your Plan

Retirement Savings Accounts

The cornerstone of most tax savings plans involves maximizing contributions to an employer sponsored retirement plan. For 2025, you can contribute up to $23,500 to your 401 k, with an additional $7,500 in catch up contributions if you’re age 50 or older. Even more attractive, employees between ages 60-63 can make an additional $3,750 catch-up contribution under the SECURE Act 2.0 provisions, bringing their total potential contribution to $34,750.

Traditional 401 k contributions provide an immediate tax deduction by reducing your current taxable income dollar-for-dollar. If you’re in the 24% federal tax bracket, a $20,000 contribution saves you $4,800 in federal taxes immediately. This strategy works particularly well if you expect to be in a lower tax bracket during retirement.

Roth 401 k options allow you to contribute after tax dollars that grow completely tax-free. While you don’t receive an immediate tax deduction, qualified withdrawals in retirement are entirely free from federal income taxes. This makes Roth contributions especially valuable for younger workers who expect their income and tax rates to increase over time.

Always prioritize capturing your full employer match before contributing elsewhere. If your company matches 50% of your first 6% contributed, that’s an immediate 50% return on your investment before any market gains. Missing out on employer matching is essentially leaving free money on the table.

Traditional IRAs provide another avenue for tax deferred retirement savings, allowing deductible contributions up to $7,000 in 2025 ($8,000 if age 50+) if your income qualifies. However, deduction eligibility phases out for higher earners who also participate in employer retirement plans. Roth IRAs accept after tax contributions with the same contribution limits, but income restrictions apply for high earners. It is important to understand Roth IRA contribution rules, including eligibility and income limits, to ensure you qualify for a Roth IRA contribution and maximize your tax-free retirement savings.

Health and Education Savings

Health savings accounts (HSAs) represent perhaps the most powerful tax advantaged account available, offering a rare “triple tax advantage.” Contributions are deductible from your current income, investments grow tax deferred, and withdrawals for qualified medical expenses are completely tax-free. For 2025, you can contribute $4,300 for individual coverage or $8,550 for family coverage, with an additional $1,000 catch-up contribution after age 55.

The key to maximizing your HSA’s value is treating it as a long-term investment vehicle rather than a spending account. Pay current medical expenses out-of-pocket when possible and let your HSA funds grow tax-free for decades. HSAs are an effective way to save for future medical expenses, taking advantage of their tax benefits. Withdrawals must be used for qualified expenses to remain tax-free; otherwise, taxes and penalties may apply. After age 65, you can withdraw funds for any purpose (paying ordinary income tax like a traditional IRA), but medical expense withdrawals remain tax-free throughout your lifetime.

529 education plans offer tax-free growth and tax-free withdrawals for qualified higher education expenses, making them essential for families planning for college costs. While contributions aren’t federally deductible, many states offer tax deductions or credits for residents. You can use up to $10,000 annually for K-12 private school tuition, and this limit increases to $20,000 starting in 2026.

The beauty of 529 plans lies in their flexibility and growth potential. Funds can be used for tuition, fees, books, supplies, and even room and board at eligible institutions, as long as they are qualified higher education expenses. Recent legislation also allows 529 funds to be rolled into Roth IRAs under certain conditions, providing additional flexibility for overfunded accounts.

Tax-Efficient Investment Strategies

Asset Location and Investment Selection

Strategic asset location involves placing different types of investments in the most tax-efficient account types based on how they’re taxed. This sophisticated strategy can add significant value to your portfolio by minimizing the annual tax drag on your investments.

Hold tax-inefficient investments like actively managed mutual funds, real estate investment trusts, and fixed income securities such as corporate and government bonds in your tax deferred accounts like 401 k plans and traditional IRAs. These investments generate substantial taxable distributions, including interest income that is sensitive to interest rate risk, and are better sheltered from current taxation. Conversely, place tax-efficient investments such as index mutual funds and individual stocks in your taxable account, where their minimal distributions and favorable capital gains treatment won’t create large annual tax bills.

Municipal bonds deserve special consideration for investors in higher tax brackets. Municipal bond income is generally exempt from federal income tax and may also be exempt from state and local taxes, making it attractive for high-income investors. Tax free municipal bonds are a key component of a tax-efficient investment strategy for those seeking to minimize tax liabilities, as these securities generate tax free interest that’s exempt from federal income taxes and often state taxes if you purchase bonds from your home state. For someone in the 32% federal bracket living in a high-tax state, municipal bonds can provide equivalent yields to much higher-yielding taxable bonds.

Exchange-traded funds (ETFs) and index mutual funds typically generate fewer taxable distributions than actively managed funds, making them ideal for taxable accounts. Their passive management style results in lower portfolio turnover, reducing capital gains distributions that would otherwise create unexpected tax bills.

Capital Gains Management

Understanding the difference between short-term and long-term capital gains is crucial for tax-efficient investing. Investors can strategically generate capital gains by timing the sale of appreciated assets to optimize their tax outcomes. Investments held for more than one year qualify for preferential long-term capital gains rates of 0%, 15%, or 20% depending on your income. Short-term gains from investments held one year or less are taxed as ordinary income, with rates reaching 37% in 2025 for high earners.

Tax-loss harvesting allows you to offset capital gains by strategically selling investments that have declined in value. You can use capital losses to eliminate capital gains taxes entirely, and excess losses can offset up to $3,000 of ordinary income annually. Any remaining losses carry forward to future tax years, providing ongoing tax benefits.

When implementing tax-loss harvesting, avoid the wash-sale rule by waiting at least 30 days before repurchasing the same or substantially identical securities. This rule prevents you from claiming a tax loss while immediately repurchasing the same investment. Consider using similar but not identical investments to maintain your portfolio’s asset allocation during the waiting period.

Strategic timing of capital gains realization can help manage your annual tax liability. If you’re having a lower-income year, consider realizing some long-term capital gains to take advantage of the 0% capital gains rate. Conversely, in high-income years, defer gains to avoid pushing yourself into higher tax brackets.

Tax Free Investments

Tax-free investments represent the ultimate strategic weapon for dismantling federal income tax obligations and supercharging your retirement wealth accumulation. Municipal bonds stand as the cornerstone of this approach—delivering tax-exempt interest income that bypasses federal taxation entirely and, in most cases, eliminates state and local tax burdens as well. For investors trapped in higher tax brackets, this becomes absolutely essential for minimizing tax inefficiencies that drain wealth.

Tax-advantaged accounts like Roth IRAs and 401k plans offer unparalleled opportunities for tax-free wealth multiplication. The Roth IRA strategy is particularly brilliant—you invest after-tax dollars upfront, but your investments compound tax-free indefinitely, and qualified retirement withdrawals escape federal taxation completely. Roth 401k accounts deliver identical tax-free withdrawal benefits, provided you meet the necessary conditions—a non-negotiable requirement for maximizing long-term wealth.

Understanding contribution limits and account-specific regulations isn't optional—it's strategically critical for maintaining compliance with current tax laws and avoiding costly mistakes. Incorporating tax-free investments into your overall wealth-building strategy dramatically enhances your portfolio's tax efficiency and ensures you retain maximum investment returns rather than surrendering them to unnecessary taxation.

Tax Diversification

Tax diversification represents a decisive strategic approach I implement to systematically manage client investments across multiple account types and tax categories—eliminating unnecessary tax burdens and maximizing long-term wealth. By strategically positioning assets among tax-advantaged accounts like traditional and Roth retirement accounts, health savings accounts, and taxable brokerage accounts, I create resilient portfolios that deliver superior outcomes. Inefficient tax planning bothers me profoundly, which is why I focus relentlessly on building flexible structures that optimize every dollar.

This systematic approach empowers me to orchestrate optimal withdrawal strategies during retirement, strategically selecting accounts based on varying tax treatments to match client needs and prevailing tax environments. For instance, I deliberately direct withdrawals from traditional IRAs during lower-income years when tax-deferred benefits maximize value, then pivot to Roth IRA distributions during higher-income periods to maintain optimal tax brackets. This coordinated strategy consistently reduces lifetime tax obligations—because precision in execution determines wealth preservation success.

My tax diversification methodology also demands rigorous analysis of investment vehicle tax implications, particularly examining mutual funds and real estate investment trusts (REITs) that generate distinct taxable income streams. Through thoughtful allocation strategies, I systematically enhance portfolio tax efficiency while securing stable retirement income flows. Strategic foresight combined with decisive implementation transforms complex tax scenarios into clarity, ensuring clients achieve optimized financial outcomes rather than accepting avoidable tax inefficiencies.

Flexibility in Tax Planning

Flexibility stands as the foundation of effective tax planning—and as someone who has guided countless clients through complex tax landscapes, I recognize that adaptability separates successful strategies from stagnant approaches. When I work with clients, my focus is decisive: developing comprehensive tax plans that strategically leverage Roth IRAs and 401k plans while maximizing every available deduction and credit. This systematic approach to tax-advantaged accounts creates measurable value that compounds over time.

My methodology demands regular plan reviews and updates—because stagnant strategies frustrate me deeply, and evolving tax laws require proactive responses. When clients experience life changes like career transitions, marriage, or approaching retirement, I immediately recalibrate their strategies. This flexibility means making bold moves: shifting contribution allocations between account types or restructuring investment portfolios to optimize tax efficiency. Reactive planning is ineffective; decisive, forward-thinking action delivers results.

Through maintaining this adaptive methodology and providing expert guidance, I consistently help clients navigate tax system complexities with confidence while minimizing their tax burdens. My goal remains clear: transform tax planning confusion into strategic clarity, ensuring clients achieve their financial objectives through well-executed, flexible approaches rather than rigid, outdated strategies.

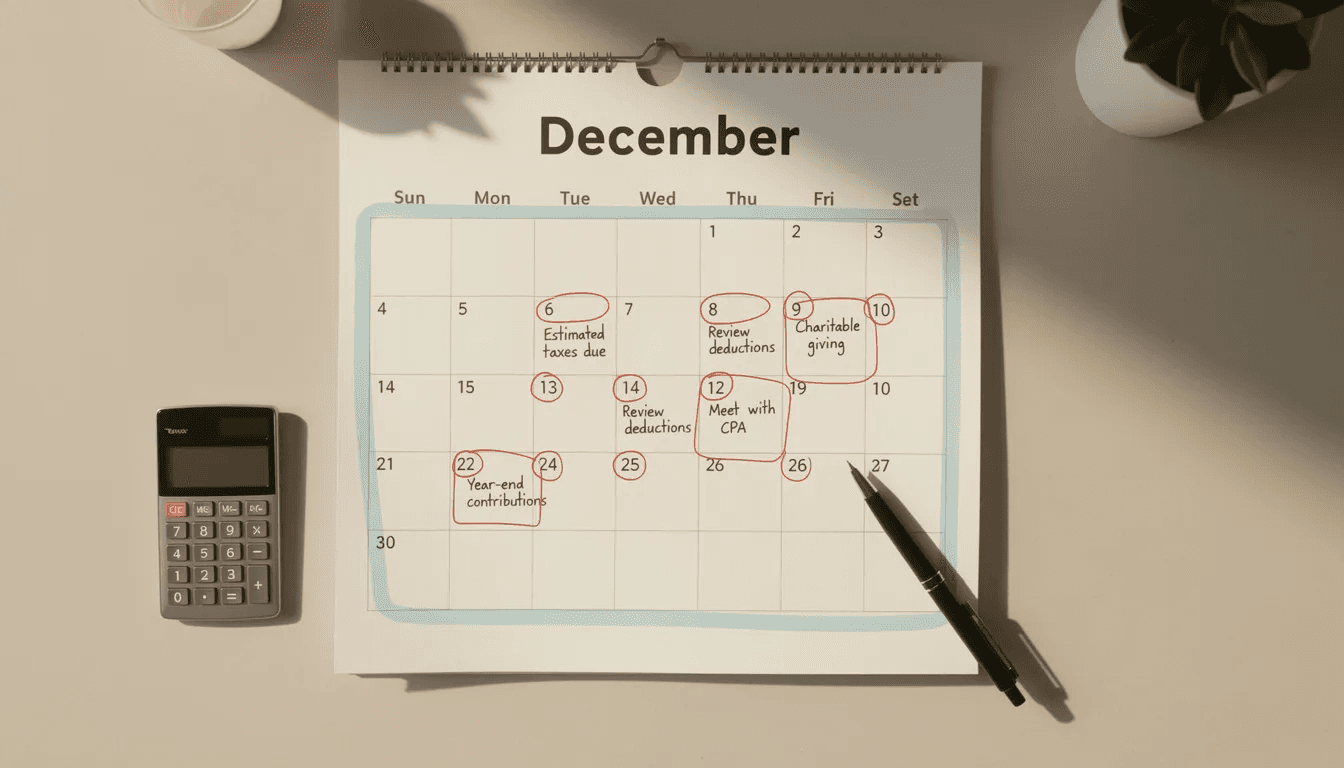

Year-End Tax Moves for 2025

December 31 Deadlines

Several critical tax planning opportunities must be completed by December 31st to affect your 2025 tax return. Most importantly, ensure you complete any required minimum distributions from traditional retirement accounts if you’re age 73 or older. The penalty for missing RMDs is severe—25% of the amount you should have withdrawn, though this reduces to 10% if you correct the error within two years.

Maximize your 401 k and 403 b contributions through payroll deduction before year-end. Unlike IRA contributions, which can be made until the tax filing deadline, employer plan contributions must be completed by December 31st. Review your year-to-date contributions to ensure you’re on track to reach the annual contribution limit.

Execute tax-loss harvesting in your taxable investment accounts before year-end to offset any realized gains from earlier in the year. Review your portfolio for positions showing losses that you can strategically realize to reduce your tax liability. Remember that you can use capital losses to offset gains plus up to $3,000 of ordinary income.

If you itemize deductions, consider accelerating charitable contributions into the current tax year. This strategy is particularly effective if you’re close to the standard deduction threshold or expect to be in a lower tax bracket next year. Donating appreciated securities allows you to eliminate capital gains taxes while claiming a charitable deduction for the full market value.

Advanced Year-End Strategies

Roth IRA conversions represent one of the most powerful year-end tax planning strategies. By converting traditional IRA funds to a Roth account, you pay taxes now in exchange for tax-free growth and withdrawals later. The key is managing the conversion amount to stay within your current tax bracket and avoid pushing income into higher rates. When considering Roth conversions or charitable giving strategies, be sure to evaluate the potential impact of the federal alternative minimum tax, as it may affect the overall tax benefits of these moves.

For example, a single filer earning $180,000 in 2025 sits near the top of the 24% tax bracket, which extends to $197,300. They could convert up to $17,300 from a traditional IRA to a Roth without moving into the 32% bracket. This strategy is particularly valuable during lower-income years or early in retirement before required minimum distributions begin.

Consider exercising stock options strategically to manage your ordinary income levels. If you have incentive stock options or non-qualified stock options, the timing of exercise can significantly impact your tax liability. Spread exercises across multiple years to avoid large spikes in taxable income that push you into higher brackets.

Qualified charitable distributions (QCDs) from IRAs offer powerful tax benefits for those age 70½ and older. You can transfer up to $100,000 annually directly from your IRA to qualifying charities, reducing your adjusted gross income without requiring itemized deductions. QCDs can satisfy required minimum distributions while providing significant tax savings.

Additional Tax Reduction Strategies

Charitable Giving and Gifting

Donating appreciated securities instead of cash provides superior tax benefits by allowing you to eliminate capital gains taxes while claiming a full fair market value deduction. If you’ve held stocks, bonds, or mutual funds for more than one year that have appreciated significantly, donating them directly to charity avoids the capital gains taxes you’d pay if you sold them first.

The annual gift tax exclusion allows you to transfer $19,000 per recipient in 2025 ($38,000 for married couples filing jointly) without triggering gift tax consequences. This strategy helps reduce the size of your taxable estate while providing financial support to family members. Consider making annual gifts of appreciated assets to spread the tax burden across multiple taxpayers in potentially lower brackets.

Bunching charitable deductions in alternating years can help exceed the standard deduction threshold and maximize your tax benefits. Instead of making modest annual charitable contributions, consider concentrating two or three years’ worth of donations into a single tax year, then taking the standard deduction in the off years.

Donor advised funds provide flexibility in charitable giving timing while maximizing immediate tax benefits. You can contribute to the fund in high-income years to claim large deductions, then recommend grants to specific charities over multiple years. This approach allows you to optimize the timing of tax deductions while maintaining control over your charitable impact.

Business and Self-Employment Tax Planning

Self-employed individuals and business owners have access to powerful retirement savings options beyond traditional IRAs. Solo 401 k plans allow business owners with no employees to contribute both as an employee and employer, potentially reaching much higher contribution limits than conventional retirement accounts.

SEP IRAs enable small business owners to contribute up to 25% of compensation or $70,000 in 2025, whichever is less. These plans are relatively simple to establish and maintain, making them attractive for small businesses and self-employed professionals. Contributions are deductible to the business and grow tax deferred for employees.

Self-employed individuals can deduct health insurance premiums paid for themselves, their spouse, and dependents as an adjustment to income. This deduction doesn’t require itemizing and can significantly reduce your adjusted gross income. The deduction is limited to your net self-employment income from the business that provided the insurance.

The home office deduction allows qualifying taxpayers to deduct expenses related to the business use of their home. You can use either the simplified method (claiming $5 per square foot up to 300 square feet) or the actual expense method (deducting the percentage of home expenses related to business use). Regular and exclusive business use of the space is required.

Creating Your Personalized Tax Savings Plan

Start by calculating your current effective tax rate and identifying opportunities for improvement. Review your most recent tax return to understand your marginal tax bracket, total tax liability, and effective rate across all income sources. This analysis reveals where tax savings strategies will have the greatest impact on your financial situation.

Prioritize strategies based on your tax bracket and available deduction space. High earners in the 32% or 37% brackets should focus on maximizing pre-tax contributions to traditional retirement accounts and implementing sophisticated investment strategies. Those in lower brackets might benefit more from Roth contributions that provide tax-free growth for the future.

Set up automatic contributions to maximize the benefits of tax advantaged accounts. Most employers allow you to automatically increase 401 k contributions annually, helping you reach contribution limits without manual intervention. Similarly, automatic monthly contributions to IRAs and HSAs ensure consistent savings while smoothing your cash flow throughout the year.

Review and adjust your plan annually based on income changes, tax law updates, and shifting financial goals. Major life events like marriage, divorce, job changes, or retirement require plan modifications to maintain optimal tax efficiency. Stay informed about legislative changes that might create new opportunities or eliminate existing strategies.

Consider consulting a tax professional for complex situations involving multiple income sources, business ownership, or significant investment portfolios. A qualified tax advisor can identify opportunities you might miss and ensure compliance with complicated regulations. The cost of professional advice often pays for itself through additional tax savings and reduced audit risk.

Track important deadlines using calendar reminders for year-end moves and Tax Day planning. Create a systematic approach to quarterly tax planning reviews, ensuring you don’t miss valuable opportunities due to timing constraints. Regular monitoring allows for mid-course corrections and proactive strategy implementation.

Your tax savings plan should evolve alongside your financial situation, but the fundamental principles remain constant: maximize tax advantaged accounts, optimize investment location, manage capital gains strategically, and coordinate timing decisions to minimize your lifetime tax burden. By implementing these strategies consistently, you can keep more of your hard-earned money working toward your financial goals rather than going toward unnecessary tax payments.

The most successful tax savings plans combine multiple strategies working together toward a common goal. Start with the basics of maximizing employer matches and HSA contributions, then gradually add more sophisticated techniques as your wealth and complexity increase. Remember that tax planning is a marathon, not a sprint—consistent application of these principles over many years will compound into substantial savings and enhanced financial security.