Tax Incentives for Saving: Complete Guide to Maximizing Your Tax Benefits in 2025

In 2025, smart savers can reduce their federal income tax bill by thousands of dollars simply by choosing the right accounts for their money. The federal government offers powerful tax incentives for saving that can transform your financial future while slashing your current tax burden.

These tax incentives for saving aren’t just minor perks—they represent one of the most effective ways to build wealth while legally minimizing what you pay federal income taxes on. Whether you’re saving for retirement, your children’s education, or unexpected medical expenses, the right tax advantaged accounts can dramatically amplify your savings power.

This comprehensive guide reveals every major tax incentive available in 2025, showing you exactly how to maximize these benefits and avoid costly mistakes that could cost you thousands in unnecessary taxes.

What you’ll learn:

How tax deferred accounts can immediately reduce your adjusted gross income

2025 contribution limits for all major retirement accounts and catch-up contribution rules

The triple tax advantage of HSAs and how to leverage them for retirement

Education tax incentives that can save thousands on tuition and fees

Strategic moves to make before December 31, 2025, to maximize your tax savings

Common mistakes that prevent people from capturing significant tax benefits

Understanding Tax Incentives for Saving

Tax incentives for saving are government policies designed to encourage you to set aside money for future needs rather than spending it today. These incentives work by either reducing your current tax bill or allowing your savings to grow tax free.

The federal government offers these tax breaks to encourage saving because higher savings rates benefit the entire economy. When more people save, it creates capital for business investment and helps individuals become more financially secure.

Choosing the right tax-advantaged accounts is a key part of an effective investment strategy, as it helps optimize both wealth growth and tax benefits.

Two Main Types of Tax Advantaged Accounts

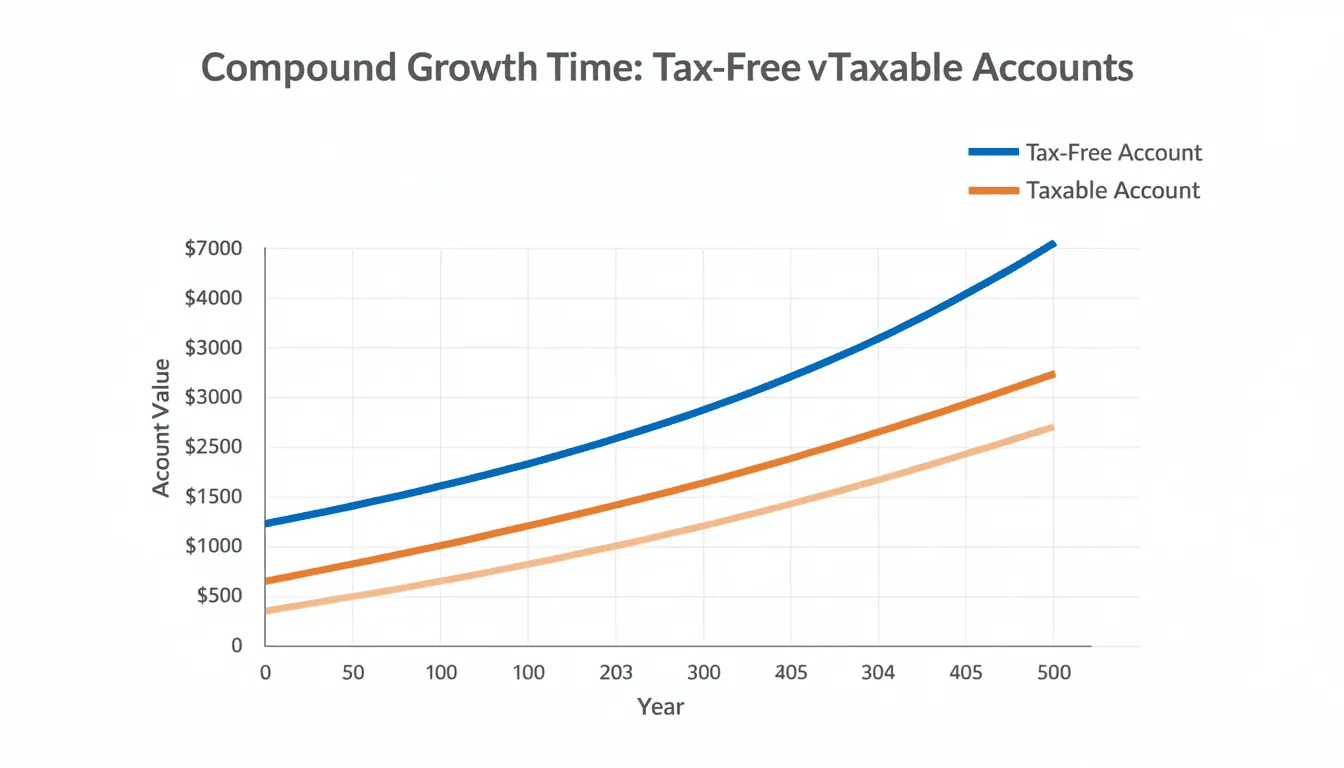

Tax deferred accounts allow you to contribute money before paying income tax on it, immediately reducing your taxable income. Popular examples include traditional IRAs and 401 k plans. You’ll pay taxes later when you withdraw the money, typically in retirement when you might be in a lower tax bracket.

Tax exempt accounts require you to pay taxes on your income first, then contribute after tax dollars. The major advantage? All future growth and qualified withdrawals are withdrawn tax free. Roth IRAs and Health Savings Accounts fall into this category. In contrast, a taxable account does not offer these tax benefits and is subject to annual taxes on earnings such as dividends, interest, and capital gains.

Both types offer tax free growth while your money remains invested, meaning you won’t pay taxes on dividends, interest income, or capital gains as your investments grow inside these accounts.

How These Incentives Reduce Your Tax Bill

When you contribute to tax deferred accounts, you can deduct contributions to traditional IRAs, which directly reduces your adjusted gross income. For someone in the 22% tax bracket contributing $3,000 to a traditional IRA, deducting contributions results in immediate tax savings of $660.

Tax exempt accounts work differently but can be even more powerful long-term. While you don’t get an immediate deduction, all future withdrawals for qualified purposes come out completely tax free—potentially saving thousands in future tax years.

Government Rationale for Offering Tax Incentives

The Internal Revenue Service and federal government promote these incentives to address three critical challenges: insufficient retirement savings among Americans, rising healthcare costs, and increasing education expenses. By offering tax breaks, the government encourages individuals to take personal responsibility for these major life expenses rather than relying solely on government programs.

Tax-Deferred Retirement Savings Accounts

Tax deferred retirement accounts represent the most widely available and powerful tax incentives for saving. These accounts allow you to reduce your current year’s taxable income while building wealth for retirement. Each account type has a maximum contribution amount set by the IRS, and contributing up to this limit can maximize your tax advantages.

2025 Contribution Limits and Catch-Up Rules

For 2025, the contribution limits have increased significantly:

Account Type | Under 50 | Ages 50+ | Ages 60-63 (2025 only) |

|---|---|---|---|

401(k) / 403(b) | $23,500 | $31,000 | $34,750 |

Traditional IRA | $7,000 | $8,000 | $8,000 |

The new super catch-up provision for 2025 allows workers aged 60-63 to contribute an additional $11,250 to their employer sponsored retirement plan beyond the standard catch up contributions. This creates an unprecedented opportunity to defer taxes on up to $34,750 in 401 k contributions.

Immediate Tax Benefits

Every dollar contributed to these accounts reduces your adjusted gross income agi dollar-for-dollar. If you’re in the 24% federal tax bracket and contribute the maximum $7,000 to a traditional IRA, you’ll save $1,680 in federal taxes alone—and potentially more when considering state and local taxes.

Required Minimum Distributions

The IRS requires this to ensure they eventually collect income tax on the deferred amounts. Failing to take these distributions results in a 50% penalty on the amount you should have withdrawn.

Employer Matching: Free Money You Can’t Ignore

Many employer sponsored retirement plans offer matching contributions—essentially free money that amplifies your tax savings. A typical match might be 50% of your contributions up to 6% of your salary. For someone earning $75,000, this could mean an additional $2,250 in your account annually, beyond your own tax-deferred contributions.

Traditional 401(k) and 403(b) Plans

Employee-sponsored plans offer the highest contribution limits and often include valuable employer matching. Understanding how to maximize these benefits can significantly impact your long-term wealth building.

Maximizing Employee Contributions and Matches

The key strategy is to contribute enough to capture your full employer match—this represents an immediate 50-100% return on your investment. If your employer matches 50% of contributions up to 6% of salary, contribute at least 6% to maximize this benefit.

For higher earners, consider contributing the maximum allowed amount to defer taxes on as much income as possible. The 2025 limit of $23,500 (or $31,000 if age 50+) can result in substantial tax savings for those in higher tax brackets.

Vesting Schedules and Job Changes

Employer contributions often come with vesting schedules, meaning you don’t immediately own 100% of employer contributions. Common schedules include:

Cliff vesting: 100% vested after a specific period (often 3 years)

Graded vesting: Gradual vesting over time (20% per year over 5 years)

When changing jobs, understand your vesting schedule to avoid leaving money on the table. You can typically roll your vested balance into your new employer’s plan or a traditional or roth ira.

Loan Options and Hardship Withdrawals

While not recommended for routine use, 401 k loans allow you to borrow against your account balance without triggering taxes or penalties. However, if you leave your job, the loan typically becomes due immediately.

Hardship withdrawals are available for specific financial emergencies but trigger both income tax and a 10% early withdrawal penalty if you’re under age 59½.

Traditional IRA Benefits and Limitations

Traditional IRAs provide tax deferred savings opportunities for anyone with earned income, but income limits may restrict the tax deductibility of contributions.

2025 Income Phase-Out Limits

If you have access to an employer sponsored retirement plan, your ability to deduct traditional IRA contributions phases out at these modified adjusted gross income levels:

Single filers: $77,000 - $87,000

Married filing jointly: $123,000 - $143,000

Married filing separately: $0 - $10,000

Above these limits, you can still contribute to traditional IRAs, but contributions won’t be deductible for tax purposes.

Spousal IRA Contributions

Non-working spouses can contribute to traditional IRAs based on the working spouse’s earned income. This effectively doubles a family’s IRA contribution capacity, allowing up to $14,000 in combined contributions ($16,000 if both spouses are 50+).

Rollover Rules from Employer Plans

When leaving an employer, you can roll 401 k or 403 b funds into a traditional IRA without triggering taxes. This preserves the tax deferred status while often providing access to a broader range of investment options and lower fees.

Tax-Free Growth Savings Accounts

Tax free growth accounts represent some of the most powerful long-term wealth building tools available. While you don’t get immediate tax deductions, the tax free withdrawals can save massive amounts over time.

In addition to tax-free growth in retirement accounts, certain investments held in a taxable account, such as municipal bonds, can generate tax free interest. This tax free interest is another way to reduce your overall tax liability outside of retirement accounts.

Roth IRA Advantages

Roth IRAs offer unique benefits that make them particularly attractive for younger savers and those expecting to be in higher tax brackets in retirement.

2025 Contribution Limits and Income Restrictions

For 2025, Roth IRA contributions are limited to:

$7,000 for those under 50

$8,000 for those 50 and older

Income eligibility phases out at these modified adjusted gross income levels:

Single filers: $150,000 - $165,000

Married filing jointly: $236,000 - $246,000

Above these limits, direct Roth IRA contributions aren’t allowed, but high earners can use the “backdoor Roth” strategy.

Five-Year Rule and Tax-Free Withdrawals

This five-year rule applies separately to each Roth conversion, creating planning opportunities for early retirees.

Contributions can always be withdrawn tax free since you already paid taxes on the money before contributing.

No Required Minimum Distributions

Unlike traditional retirement accounts, Roth IRAs have no required minimum distributions during the owner’s lifetime. This makes them excellent estate planning tools and allows continued tax free growth throughout retirement.

Tax-Free Inheritance Benefits

Beneficiaries inherit Roth IRAs tax free, though they must generally withdraw all funds within 10 years under current law. This creates significant wealth transfer opportunities for families.

Health Savings Accounts (HSAs)

HSAs offer the most comprehensive tax advantages available—often called the “triple tax advantage” because they provide benefits unavailable with any other account type.

Unlike flexible spending accounts, all the money in your HSA can be carried over from year to year, allowing you to accumulate savings for future medical expenses.

The Triple Tax Advantage Explained

Tax deductible contributions: HSA contributions reduce your adjusted gross income, providing immediate tax savings

Tax free growth: Investment earnings inside HSAs grow without generating taxable income

Tax free withdrawals: Distributions for qualified medical expenses are never taxed

No other account type offers all three benefits simultaneously.

2025 HSA Contribution Limits

For 2025, HSA contribution limits are:

Individual coverage: $4,300

Family coverage: $8,550

Catch-up contributions (age 55+): Additional $1,000

High-Deductible Health Plan Requirements

To contribute to an HSA, you must be enrolled in a qualified high-deductible health plan. For 2025, this means:

Individual plans: Minimum deductible of $1,650

Family plans: Minimum deductible of $3,300

Retirement Healthcare Planning with HSAs

After age 65, HSA withdrawals for any purpose are treated like traditional IRA withdrawals—subject to ordinary income tax but no penalties. This makes HSAs function as supplemental retirement accounts while providing tax free access to funds for medical expenses throughout your lifetime.

Given rising healthcare costs in retirement, HSAs represent one of the most strategic long-term savings vehicles available.

Roth 401(k) and After-Tax Contributions

Some employer plans offer Roth 401 k options, allowing you to make after-tax contributions that grow tax free. Combined with traditional after-tax contributions, this creates advanced strategies for high earners.

Mega Backdoor Roth Strategy

High earners can potentially contribute up to $70,000 annually to employer plans through a combination of:

Regular 401 k contributions ($23,500)

Employer matching

After-tax contributions (up to the total limit of $70,000)

Immediate conversion of after-tax amounts to Roth

This strategy requires specific plan features but can dramatically accelerate tax free savings accumulation.

In-Service Distributions and Rollover Options

Some plans allow in-service distributions of after-tax contributions, enabling immediate conversion to Roth accounts. This prevents the after-tax money from generating taxable earnings in the qualified retirement plan.

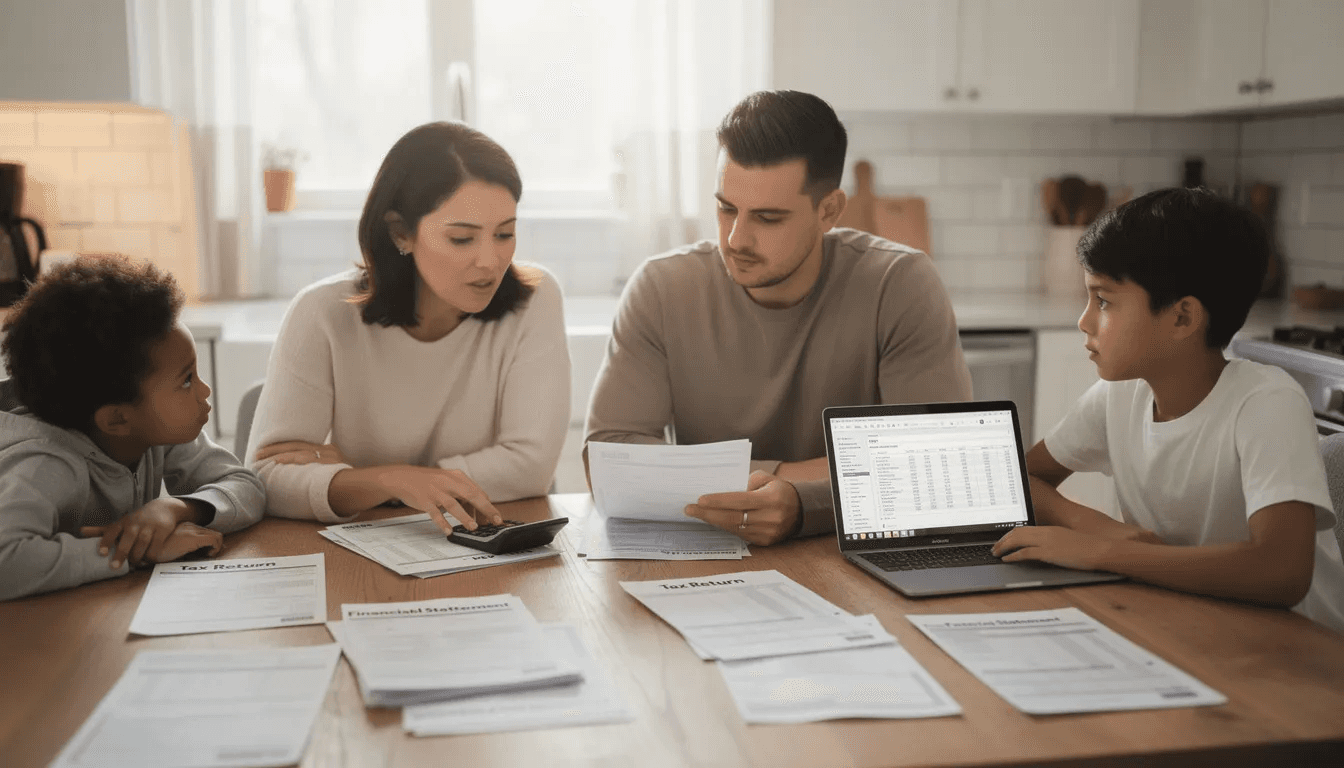

Education Savings Tax Incentives

Education expenses represent a major financial burden for families, but several tax incentives for saving can significantly reduce these costs. When using education savings accounts or claiming education credits, it is important to understand which costs are considered eligible expenses for tax purposes.

529 Education Savings Plans

529 plans offer tax free growth and tax free withdrawals for qualified higher education expenses, making them the primary education savings vehicle for most families.

Key benefits:

No income limits for contributions

High contribution limits (often $300,000+ per beneficiary)

State tax deductions in many states

Tax free growth and qualified withdrawals

Expanded K-12 Usage

Since 2018, 529 plans can be used for K-12 tuition expenses up to $10,000 annually per beneficiary. This expands their usefulness beyond college planning to include private elementary and secondary education.

State Tax Benefits

Many states offer tax deductions or credits for 529 plan contributions to their state-sponsored plans. These benefits can add substantially to the federal tax advantages:

Full deduction states: Residents can deduct entire contribution amount

Partial deduction states: Limited deductions, often $2,000-$10,000 annually

Tax credit states: Direct credit against state taxes owed

Coverdell Education Savings Accounts

Coverdell ESAs offer similar tax benefits to 529 plans but with lower contribution limits ($2,000 annually) and broader qualified expense definitions. They can be used for K-12 expenses beyond tuition, including books, supplies, and equipment.

American Opportunity Tax Credit

This credit provides up to $2,500 annually for qualified education expenses during the first four years of college. The credit phases out for higher-income taxpayers but provides valuable benefits for middle-income families:

100% of first $2,000 in expenses

25% of next $2,000 in expenses

Partially refundable (up to $1,000)

Lifetime Learning Credit

The Lifetime Learning Credit offers 20% of qualified tuition and fees up to $10,000 annually, providing a maximum credit of $2,000. Unlike the American Opportunity Credit, this applies to all years of education and includes graduate school and professional development courses.

Tax Credits and Deductions for Savers

Beyond account-based incentives, several tax credits and deductions directly reward saving behavior and education expenses.

A notable example is the residential clean energy credit, which provides a valuable tax incentive for homeowners who invest in solar panels or other qualifying energy-efficient home improvements. This credit is currently available due to recent legislation, but it is important to note that its benefits and eligibility may change or expire in the coming years, so homeowners should review the latest IRS guidelines to maximize their savings.

Saver’s Credit: Direct Incentive for Retirement Saving

The Retirement Savings Contributions Credit, or Saver’s Credit, provides a direct tax credit for eligible retirement plan contributions. This credit is worth 10%, 25%, or 50% of contributions up to $2,000, depending on income level.

2025 Income Limits for Maximum Credit:

50% credit: AGI up to $23,750 (single) / $47,500 (married filing jointly)

25% credit: AGI up to $26,000 (single) / $52,000 (married filing jointly)

10% credit: AGI up to $40,000 (single) / $80,000 (married filing jointly)

The Saver’s Credit is particularly valuable because it’s a dollar-for-dollar reduction in taxes owed, not just a deduction from taxable income.

Student Loan Interest Deduction

Borrowers can deduct up to $2,500 annually in student loan interest payments, even if they don’t itemize deductions. This above-the-line deduction reduces adjusted gross income and phases out for higher-income taxpayers.

Above-the-Line vs. Itemized Deductions

Understanding the difference between above-the-line deductions and itemized deductions is crucial for tax planning:

Above-the-line deductions reduce your adjusted gross income and are available regardless of whether you itemize. These include:

Traditional IRA contributions

HSA contributions

Student loan interest

Educator expenses

Itemized deductions are claimed instead of the standard deduction and include:

State and local taxes (capped at $10,000)

Mortgage interest

Charitable donations

Medical expenses exceeding 7.5% of AGI

For 2025, the standard deduction is $15,000 for single filers and $30,000 for married couples filing jointly. Most taxpayers benefit more from the standard deduction unless their itemized deductions significantly exceed these amounts.

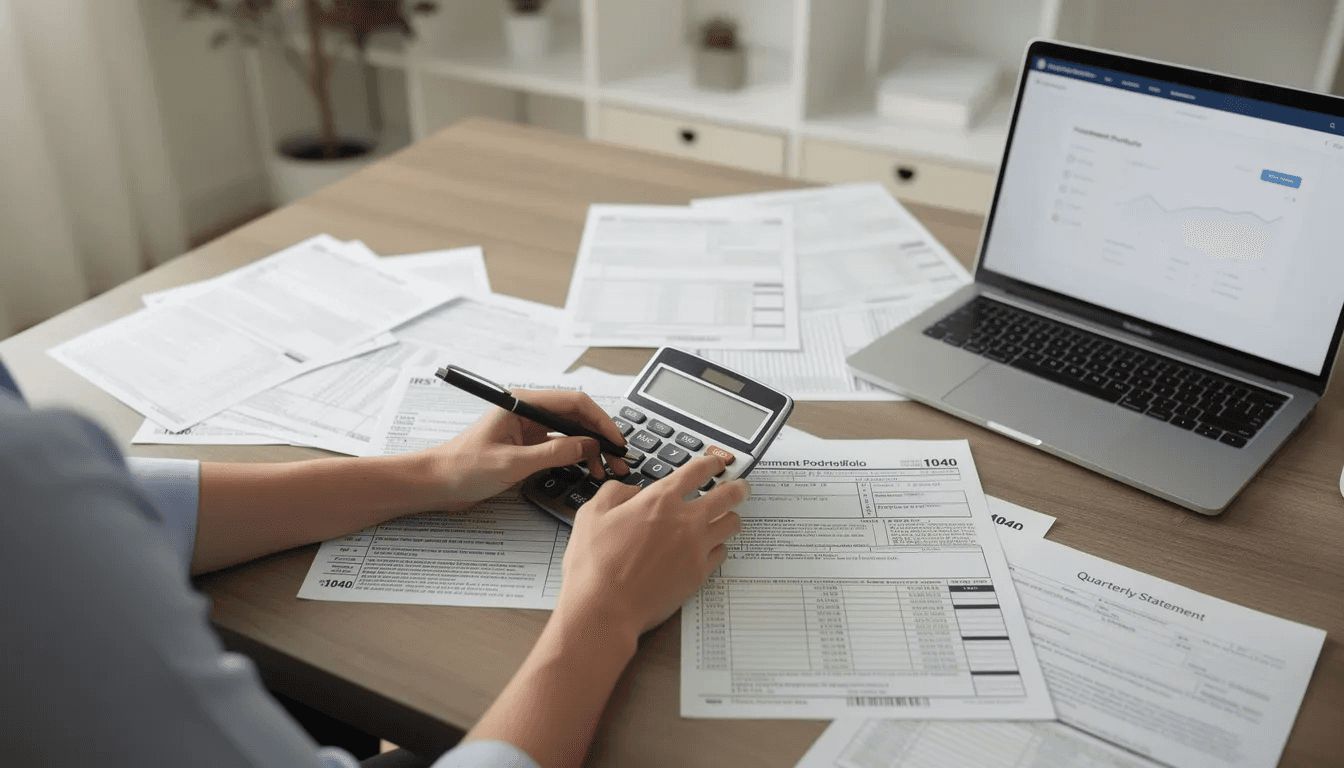

Strategic Tax Planning for Maximum Savings

Sophisticated savers can amplify their tax benefits through strategic planning that coordinates multiple account types and timing decisions.

Roth Conversion Strategies

Roth conversions involve moving money from traditional retirement accounts to Roth accounts, paying income tax on the converted amount. Strategic conversions can:

Fill up lower tax brackets in years with reduced income

Reduce future required minimum distributions

Create tax free inheritance for heirs

Optimal timing for conversions:

Years between retirement and age 73 (before RMDs begin)

Market downturns when account values are temporarily reduced

Years with unusually low income

Tax Bracket Management

Understanding your marginal tax rate helps optimize the timing of income and deductions:

22% bracket: Consider maximizing traditional retirement account contributions

12% bracket: Roth contributions or conversions might be more advantageous

24% bracket or higher: Traditional contributions typically provide greater immediate benefits

Asset Location Strategies

Different types of investments work better in different account types:

Tax-advantaged accounts are ideal for:

High-yield bonds and REITs (high ordinary income)

Frequently traded investments (avoiding capital gains)

High-growth stocks held long-term

Taxable accounts work better for:

Tax-efficient index funds

Individual stocks held over one year (favorable capital gains rates)

Investments you might need to access before retirement

Tax-Loss Harvesting

Selling investments at a loss to offset capital gains can reduce your current tax bill while maintaining your investment allocation. Key strategies include:

Harvesting losses to offset up to $3,000 of ordinary income annually

Using losses to offset capital gains from other investments

Avoiding wash sale rules by waiting 31 days before repurchasing identical securities

Charitable Giving Strategies

Donor advised funds and qualified charitable distributions from IRAs offer tax-efficient giving opportunities:

Donor advised funds are a strategic tool for charitable giving, providing immediate tax deductions while allowing you to distribute donations to charities over multiple years. With a donor advised fund, you can:

Bunch charitable deductions in high-income years

Contribute appreciated securities to avoid capital gains taxes

Recommend grants to charities over time

Qualified charitable distributions from traditional IRAs:

Count toward required minimum distributions

Exclude the distribution from taxable income

Available starting at age 70½

Year-End Tax Moves for 2025

Certain tax-advantaged saving opportunities have strict deadlines that require action before December 31, 2025.

December 31 Deadlines

401 k and 403 b contributions must be made through payroll deduction by December 31 to count for the 2025 tax year. Contact your human resources department early in December to ensure proper withholding.

Required minimum distributions must be completed by December 31 for anyone age 73 or older. The penalty for missing this deadline is 50% of the amount you should have withdrawn.

HSA contributions through payroll deduction must occur by December 31, though individual contributions can be made until April 15, 2026.

April 15, 2026 Deadlines

IRA contributions for 2025 can be made until April 15, 2026, providing flexibility for tax planning after year-end.

HSA contributions made outside of payroll deduction have until April 15, 2026, to count for the 2025 tax year.

Strategic Year-End Moves

Tax-loss harvesting should be completed by December 31 to offset 2025 capital gains and income.

Charitable contribution bunching involves making multiple years’ worth of donations in 2025 if it allows you to itemize deductions and exceed the standard deduction.

Roth conversions must be completed by December 31 and cannot be reversed, making careful planning essential.

Common Mistakes to Avoid

Even well-intentioned savers can make costly errors that reduce their tax benefits or trigger unnecessary penalties.

Missing Employer Match Opportunities

Failing to contribute enough to capture your full employer 401 k match represents leaving free money on the table. This mistake costs the average worker thousands of dollars annually in missed opportunities.

Solution: Contribute at least enough to maximize your employer match, even if you can’t afford the full annual contribution limit.

Early Withdrawal Penalties and Exceptions

Traditional and Roth IRA exceptions:

First-time home purchase (up to $10,000 lifetime)

Qualified higher education expenses

Medical expenses exceeding 7.5% of AGI

Health insurance premiums while unemployed

Roth IRA specific rules:

Contributions can always be withdrawn penalty-free

Earnings withdrawals require 5-year seasoning for penalty-free access

Exceeding Contribution Limits

Contributing more than allowed limits triggers a 6% excise tax annually until the excess is corrected. This tax applies each year the excess remains in the account.

Correction strategies:

Withdraw excess contributions before the tax filing deadline

Apply excess contributions to the following year if under that year’s limit

Recharacterize traditional IRA contributions as Roth contributions if income allows

Missing Required Minimum Distributions

The 50% penalty for missing required minimum distributions is one of the harshest IRS penalties. Starting at age 73, you must calculate and withdraw specific amounts from traditional retirement accounts annually.

Prevention strategies:

Set calendar reminders for RMD deadlines

Automate distributions through your account custodian

Consider qualified charitable distributions to satisfy RMDs

Neglecting Tax Diversification

Having all retirement savings in traditional tax deferred accounts creates tax concentration risk. Consider spreading savings across account types to provide flexibility in retirement:

Traditional accounts: Provide current tax deductions

Roth accounts: Offer tax free future withdrawals

Taxable accounts: Provide liquidity and favorable capital gains rates

Ignoring State Tax Implications

State taxes can significantly impact your overall tax burden, especially for retirement account withdrawals. Consider:

No-income-tax states: May favor traditional retirement account contributions

High-tax states: Might make Roth accounts more attractive

Retirement relocation: Could affect the optimal account mix

Getting Started with Tax-Advantaged Saving

Beginning your tax-advantaged saving journey requires understanding priorities and developing a systematic approach that maximizes your available benefits.

Priority Order for Funding Accounts

Financial experts generally recommend this priority sequence for most savers:

Emergency fund: 3-6 months of expenses in easily accessible savings accounts

Employer 401 k match: Contribute enough to capture the full match

High-interest debt payoff: Credit cards and other debt above 6-7% interest rates

HSA maximum contribution: If eligible, maximize the triple tax advantage

Roth IRA or remaining 401 k space: Based on current vs. expected future tax rates

Taxable investment accounts: For goals beyond retirement

This sequence ensures you capture guaranteed returns (employer matching) and tax benefits before moving to purely investment-focused goals.

Calculating Your Optimal Savings Rate

Most financial advisors recommend saving 10-20% of your income for retirement, but tax incentives can make higher savings rates more affordable:

Example calculation for $75,000 income earner:

401 k contribution: $15,000 (20% of income)

Tax savings in 22% bracket: $3,300

Net impact on take-home pay: $11,700 (15.6% of income)

The tax deduction effectively subsidizes your savings, making higher contribution rates more manageable.

Working with Tax Professionals

Complex tax situations benefit from professional guidance:

Consider a tax advisor when:

Your modified adjusted gross income approaches phase-out limits

You’re eligible for multiple tax credits and deductions

You’re planning Roth conversions or asset location strategies

You own a business or have significant investment income

Look for professionals with:

CPA or Enrolled Agent credentials

Experience with retirement and education planning

Fee-based rather than commission-based compensation

Proactive tax planning approach

Monitoring Tax Law Changes

Tax laws affecting retirement and education savings change regularly. Stay informed through:

IRS publications and announcements

Annual contribution limit updates

Changes to income phase-out limits

New tax credits or deduction opportunities

The Internal Revenue Service publishes updated contribution limits each fall for the following year, allowing time for planning adjustments.

Regular Review and Strategy Adjustment

Your optimal tax-advantaged saving strategy evolves with your circumstances:

Annual review considerations:

Income changes affecting tax brackets and deduction eligibility

Family status changes impacting available credits and deductions

Investment performance affecting asset allocation across account types

Legislative changes affecting available tax benefits

Life event triggers for strategy updates:

Job changes affecting employer sponsored retirement plan access

Marriage or divorce altering filing status and income limits

Home purchases creating mortgage interest deductions

Children approaching college age requiring education savings acceleration

Starting Small and Building Momentum

Don’t let perfect become the enemy of good when beginning tax-advantaged saving:

Month 1: Start with employer 401 k contributions to capture any available match Month 2-3: Open and fund an HSA if eligible, or begin IRA contributions Month 4-6: Increase contribution percentages gradually as your budget adjusts Month 6-12: Add education savings through 529 plans if you have children

Building saving habits gradually creates sustainable long-term success while immediately capturing available tax benefits.

The power of tax incentives for saving becomes most apparent over time. A 25-year-old contributing $6,000 annually to a Roth IRA could accumulate over $1.3 million by retirement—all withdrawn tax free. Combined with tax deferred 401 k savings and strategic use of HSAs for healthcare expenses, these incentives can transform your financial future while reducing your current tax burden.

Smart savers in 2025 have unprecedented opportunities to reduce their federal tax liability while building wealth through tax advantaged accounts. The key lies in understanding which incentives apply to your situation, maximizing contribution limits where possible, and avoiding common mistakes that can trigger penalties or reduce benefits.

Whether you’re just starting your career or approaching retirement, tax incentives for saving offer powerful tools to achieve your financial goals while keeping more money in your pocket. Take advantage of these government-backed incentives to pay taxes more efficiently and build a more secure financial future.

Ready to maximize your tax benefits? Start by reviewing your current saving strategy and identifying opportunities to increase your use of tax advantaged accounts. Consider consulting with a tax professional to ensure you’re capturing all available incentives for your specific situation. The sooner you begin optimizing your approach to tax-advantaged saving, the more you’ll benefit from the power of tax free and tax deferred growth over time.