How Do I Buy Gold and Silver: A Simple Guide to Purchasing Precious Metals

Thinking about how do I buy gold and silver? You’re in the right place. This guide will walk you through the key methods, important considerations, and practical tips to help you make informed decisions. Whether you prefer physical bullion, ETFs, or mining stocks, we’ve got you covered.

Key Takeaways

Investing in precious metals can be done through physical bullion, ETFs, or mining stocks, each providing unique advantages and challenges.

Most investors may find ETFs or mutual funds more suitable than direct ownership of physical metals, due to convenience and lower barriers to entry.

Choosing a reputable dealer, whether online or local, is crucial for ensuring the authenticity of purchased gold and silver.

Key factors to consider when buying precious metals include market trends, authenticity verification, and secure storage options.

Methods to Purchase Gold and Silver

When it comes to investing in precious metals, there are several methods to consider, each with its own set of advantages and challenges. Gold and silver can be purchased in various forms, such as physical bullion or paper-based investments, allowing investors to select the structure that best fits their needs. You can choose from physical bullion, exchange-traded funds (ETFs), and mining stocks, depending on your investment goals and preferences.

Grasping the various methods of investing in precious metals is vital. Whether you lean towards the tangibility of physical bullion or the ease of ETFs, choosing the appropriate method can greatly influence your investment approach. We will explore each option to assist you in making a well-informed choice. For example, many investors start by buying gold bullion or investing in a gold ETF to gain exposure to the market.

Investing in Physical Bullion

Investing in physical bullion is a direct way to acquire precious metals. This approach includes:

Buying gold bars

Buying silver bars

Buying gold coins

Buying silver coins

Buying gold bullion

Buying silver rounds

Other tangible metals

Bars and coins are the primary types, offering choices based on personal preferences. Some coins and bars are considered collectibles due to their unique designs or limited editions, which can add numismatic or aesthetic value beyond just metal content. However, premiums above current trading prices can influence the total investment money cost.

Verifying the authenticity of physical metals ensures you receive genuine products. Purchasing gold from London Bullion Market Association-certified brands guarantees quality. Techniques for verification include:

Checking assay certificates

Examining security features

Verifying weight, size, and design consistency

Conducting advanced tests like conductivity and sound assessments These methods further confirm the genuineness of your investment.

Purchasing physical metals involves actual delivery to the buyer, providing direct ownership and control.

While physical bullion offers the advantage of actual ownership and control, it often leads to higher transaction costs and requires secure storage solutions. Despite these challenges, many investors find the tangible nature of physical metals appealing, making it a popular choice for those looking to buy gold and silver.

Exchange Traded Funds (ETFs)

For those who prefer a more hands-off approach, Exchange Traded Funds (etf) offer a convenient alternative to physical bullion. Gold and silver ETFs provide liquidity, convenience, and lower costs compared to purchasing physical metals due to their operational efficiencies. To purchase gold and silver ETFs, investors need to open a brokerage account. This makes them an attractive option for many investors interested in silver bullion.

When selecting precious metals ETFs, it’s essential to evaluate factors such as:

Expense ratio

Tracking error

Trading volume

For instance, SPDR Gold Shares (GLD) is a popular gold ETF that many investors consider. Considering these aspects can enhance your investment strategy, helping you make the most of the benefits offered by ETFs in the precious metals market.

Mining Stocks

Investing in mining stocks is another way to gain exposure to precious metals without directly owning the physical commodity. Companies that extract precious metals like gold and silver, including silver mining companies, often see their stock values correlate with the prices of these metals. This correlation provides investors with an indirect way to benefit from movements in the precious metals market.

Investing in mining stocks comes with inherent risks. Market volatility and operational challenges can affect stock value. While these risks must be carefully considered, the potential for higher returns makes mining stocks an attractive option for some investors.

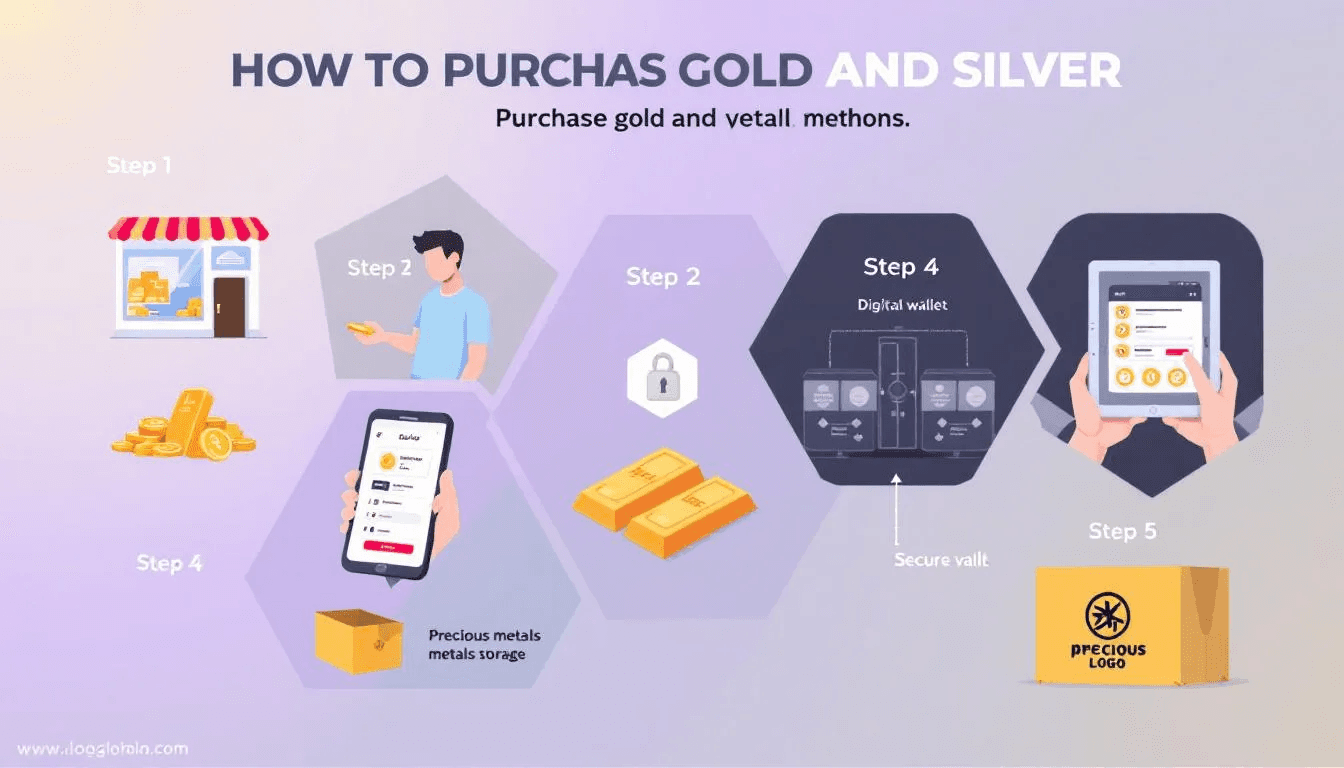

Online vs. Local Dealers

Once you’ve decided on your preferred method of investing in precious metals, the next step is to choose where to buy them. The two common places to purchase physical gold and silver are online dealers and local coin shops and resale stores. Each option has its benefits and drawbacks, and understanding these can help you make the best choice for your needs.

A dealer’s reputation is vital for ensuring the authenticity of purchased metals. Whether you choose the convenience of online dealers or the personalized service of local coin shops and stores, selecting a reputable company dealer is essential for a successful investment. Both online and local stores require customers to pay at the point of sale, though the payment process may differ.

Online Dealers

Buying from online dealers offers several advantages:

Many online dealers provide extensive selections that local shops cannot match due to physical space limitations. Buying silver online offers a wide variety of silver bullion products, often at competitive prices.

Purchasing gold online can offer better price competitiveness since online dealers typically operate on lower overhead costs.

This translates to better prices for customers.

Another significant benefit is the convenience of online purchases, with dealers available 24/7. This allows for easy browsing, price comparison, and transaction completing at any time, ensuring a hassle-free buying experience and leading to more business at the best prices, creating a strong connection between customers and dealers, ultimately enhancing the customer experience and ensuring that customers are satisfied with great service and selling.

Local Coin Shops

Local coin shops offer the unique advantage of allowing you to:

View items in person before buying, enabling hands-on inspection of quality and authenticity for peace of mind.

Engage in face-to-face interactions with dealers, which can build trust and lead to a better trade deal.

Receive immediate feedback, which is invaluable for many buyers and can help you sell your items more effectively.

However, local coin shops are bound by specific locations and business hours. Additionally, their detailed inventory is generally more limited compared to online dealers, potentially restricting your choices.

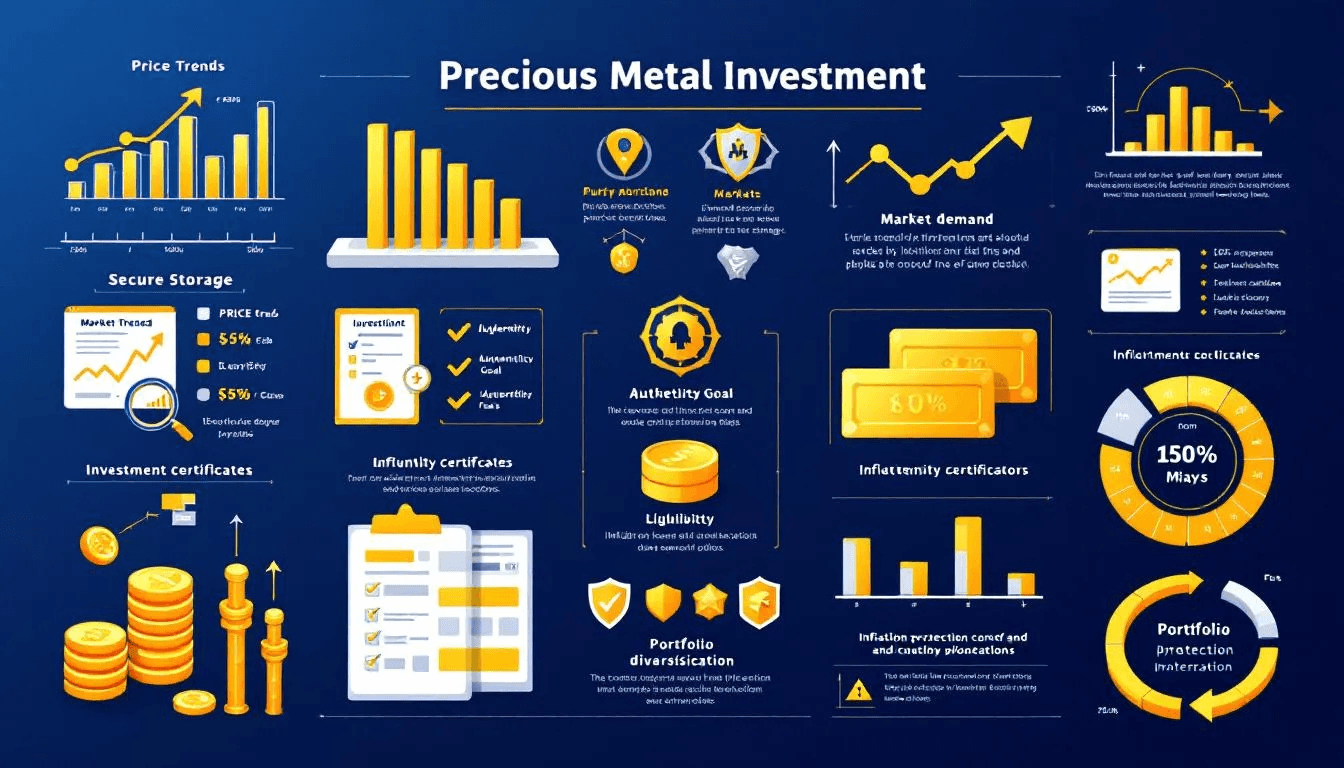

Factors to Consider When Buying Precious Metals

When purchasing precious metals, there are several key factors to consider to ensure a successful investment. These include pricing and market trends, authenticity and verification, and storage and security. Understanding these factors can help you navigate the complexities of the precious metals market and make informed decisions that align with your investment goals. There are many ways to buy gold and silver today, so it's important to choose the method that best fits your needs.

Pricing and Market Trends

The precious metals market is known for its volatility. Significant price fluctuations can occur, making it crucial for investors to stay informed about current trends. Monitoring market trends through financial news, price charts, and historical performance can help you identify the best times to purchase gold and silver.

Keeping up with market trends allows you to make informed decisions and capitalize on price fluctuations to purchase precious metals at optimal prices.

Authenticity and Verification

Verifying the authenticity of purchased metals is crucial to avoid counterfeits. Reputable dealers often provide certificates of authenticity and other verification methods to ensure the genuineness of your investment.

Taking these steps can help you secure your investments and guarantee its value, proceeding with caution as an investor to invest wisely.

Storage and Security

Storing physical bullion requires secure options to protect your investment. Options include using a home safe, a third-party depository, or a safe deposit box at a bank. Each method comes with its own set of costs and security considerations.

Choosing a secure storage facility is crucial to protect your precious metals from theft and other risks. Consider the jurisdiction of the storage facility to ensure it offers a secure environment for your assets.

Diversifying Your Portfolio with Precious Metals

Diversifying your investment portfolio with precious metals, including palladium and other precious metals, can provide stability and protection against market volatility. Gold and silver are regarded as safe-haven assets, particularly appealing during times of geopolitical instability. Platinum is another valuable precious metal that investors often consider for diversification, given its value, purity, and availability in forms like bullion bars and popular coins. Their intrinsic value and constant demand make them liquid assets that can be easily bought and sold.

Investing in precious metals adds diversity to your portfolio, helping to reduce overall investment risk. Unlike traditional investments such as stocks and bonds, precious metals offer an alternative asset class that can provide resilience during market volatility and help mitigate the risks associated with typical financial assets. They often serve as a hedge against inflation, as their value typically increases when currency purchasing power declines. Owning physical bullion also means you have direct control and ownership over your precious metals.

Using Gold and Silver IRAs

Gold and silver IRAs are self-directed accounts that allow you to hold physical precious metals with tax advantages. To invest in physical gold or silver, you must open a dedicated account specifically designed to hold these assets, and be aware of setup, management, and storage fees associated with the account. They are particularly beneficial for younger investors but can be advantageous for investors of all ages. Traditional Gold IRAs permit tax-deferred growth, meaning taxes are only paid upon withdrawal during retirement.

Roth Gold IRAs allow for tax-free withdrawals in retirement, provided certain criteria are met. It’s essential to choose IRS-approved precious metals for Gold IRAs to maintain tax advantages and avoid penalties. Consulting with a professional can provide further guidance and address specific questions.

Best Practices for Buying Gold and Silver

When purchasing precious metals, consider the following:

Set a budget beforehand to prevent overspending and narrow your options.

Conduct thorough research on dealers to ensure they are reputable and offer fair prices.

Be aware of fees associated with buying precious metals, such as shipping and insurance, for accurate budgeting. Additionally, if you’re looking to buy precious metals, make sure to factor in these costs.

Keeping an inventory of all stored precious metals for security and insurance purposes is advisable. Additionally, maintaining privacy during the transaction process can enhance safety, especially when buying precious metals online.

Summary

The answer to how to buy gold and silver depends on your investment goals and preferred methods, as discussed in this article.

Investing in precious metals like gold and silver can be a strategic way to diversify your portfolio, protect against inflation, and ensure financial stability. Whether you choose physical bullion, ETFs, or mining stocks, understanding the different methods and factors to consider is crucial for making informed decisions.

By carefully selecting reputable dealers, verifying authenticity, and considering secure storage options, you can maximize the benefits of your precious metals investment. Embrace the timeless value of gold and silver to safeguard your wealth for the future.

Frequently Asked Questions

What are the main methods to invest in gold and silver?

Investing in gold and silver can be effectively done through physical bullion, exchange-traded funds (ETFs), and mining stocks, each offering unique benefits and considerations. Choose the method that aligns best with your investment goals.

How can I ensure the authenticity of my precious metals?

To ensure the authenticity of your precious metals, always purchase from reputable dealers, verify assay certificates, and consider advanced testing methods such as conductivity and sound assessments. These steps will help you confidently establish your metals' legitimacy.

What are the advantages of buying precious metals from online dealers?

Buying precious metals from online dealers provides better prices, a wider selection, and the convenience of purchasing anytime. This makes it a practical choice for investors seeking flexibility and value.

Why should I consider diversifying my portfolio with precious metals?

Diversifying your portfolio with precious metals provides stability and serves as a hedge against inflation, protecting your investments during times of geopolitical instability. It's a strategic move to enhance your financial security.

What are the benefits of using Gold and Silver IRAs?

Gold and Silver IRAs provide significant tax advantages while allowing for tax-deferred or tax-free growth, effectively diversifying your retirement savings with physical precious metals. This combination enhances the potential for financial security in retirement.