Gold Market for Today: Live Prices and Trading Analysis

The gold market for today reflects significant underlying trends that savvy investors cannot afford to ignore. With gold prices maintaining strong momentum near historically elevated levels, and a recent rise in gold prices driven by various market factors, and Federal Reserve policy expectations driving substantial market activity, understanding current market dynamics has become crucial for both active traders and long-term precious metals investors.

As we examine today’s gold market performance, several key factors are converging to create compelling trading opportunities and investment considerations. From live gold price movements across major currencies to technical indicators suggesting potential breakout scenarios, it is important to note that the broader economy plays a significant role in gold's appeal as a safe-haven asset, especially during periods of economic uncertainty. Today’s analysis provides the essential insights needed to navigate this dynamic market environment effectively.

Today’s Gold Price Overview

Gold is currently trading at 4,208.93 US dollars per troy ounce, representing a modest gain of 0.07% from yesterday’s close. This current price level demonstrates the resilience that has characterized the precious metals market throughout recent trading sessions, particularly as investors continue to seek safe haven assets amid evolving economic conditions.

The spot gold price opened today near 4,197.66 USD, establishing a trading range that reflects measured investor sentiment. Today’s daily high reached approximately 4,215 USD per troy ounce, while the daily low tested support around 4,190 USD, indicating relatively contained volatility compared to the dramatic price movements seen throughout the broader 2025 trading year.

Currency analysis reveals interesting divergences across major international markets. In canadian dollars, gold is trading at approximately 5,880 CAD per ounce, while australian dollars show pricing around 6,420 AUD per ounce. The japanese yen valuation stands at roughly 631,000 JPY per troy ounce, highlighting how currency values significantly impact regional gold market accessibility and investment appeal.

Currently, the gold price per gram is about 135.36 US dollars, a key metric for investors who track gold in smaller denominations and monitor real-time market trends.

The live gold price demonstrates remarkable year-to-date performance, with gains of 58.84% compared to the same period last year. This exceptional appreciation reflects the confluence of factors that have driven precious metals to new highs throughout 2025, establishing gold as one of the standout commodity investments of the year.

Key Market Drivers Impacting Gold Today

Federal Reserve policy developments continue to serve as the primary catalyst for gold market activity today. Market participants are positioning themselves ahead of widely expected Federal Reserve announcements, with physical precious metals dealers reporting increased bullion purchasing activity. The anticipation of potential monetary policy shifts has created heightened demand for gold as investors seek to hedge against currency devaluation risks and lower rates scenarios.

The US dollar’s performance today directly influences gold pricing dynamics, as the inverse relationship between dollar strength and gold values remains a critical market driver. Current dollar weakness has provided additional support for gold prices, making the precious metal more attractive to international investors and supporting today’s positive price action.

Geopolitical tensions continue to underpin safe haven demand for gold and other precious metals. International uncertainties have prompted institutional investors to increase their allocation to physical gold and gold certificates as portfolio diversification tools. This ongoing geopolitical premium reflects investors’ recognition of gold’s historically proven ability to preserve value during periods of global uncertainty.

Economic data releases scheduled for today include inflation indicators and employment statistics that could significantly impact gold market sentiment. These data points will provide crucial insights into the Federal Reserve’s future policy trajectory, potentially influencing gold futures contracts and spot price movements throughout the remainder of the trading session. The live gold price in the market is often determined by the gold futures contract, particularly the most actively traded month on exchanges like COMEX, which serves as a benchmark for spot pricing.

Central bank activity remains a significant factor, with several major central banks continuing to increase their gold reserves as part of broader monetary policy strategies. This institutional demand provides fundamental support for gold prices and contributes to the overall positive sentiment in today’s gold market.

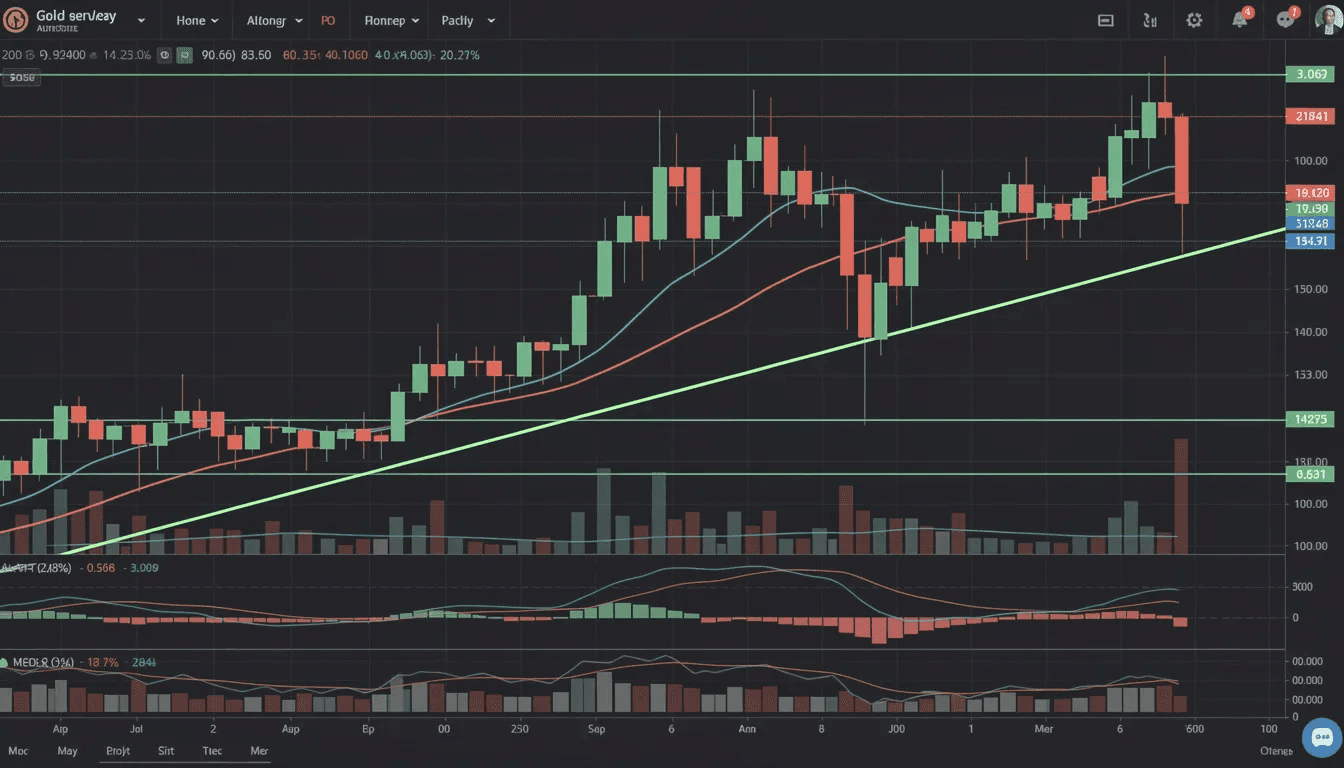

Technical Analysis for Today’s Trading

Key support levels for today’s gold trading session are established around 4,180 USD per troy ounce, representing a confluence of previous resistance-turned-support and the 20-day moving average. This support zone has proven resilient during recent pullbacks and represents a critical level for maintaining the current uptrend structure.

Resistance levels are clearly defined at 4,240 USD per ounce, corresponding to the recent swing highs established during the November rally. A decisive break above this resistance would likely trigger additional buying interest and potentially target the October all-time highs near 4,381.58 USD per troy ounce.

Moving average analysis reveals a bullish configuration across all major timeframes. The 20-day moving average currently sits at 4,165 USD, while the 50-day average provides support around 4,090 USD. The 200-day moving average, positioned near 3,850 USD, demonstrates the substantial uptrend that has characterized the gold market throughout 2025.

Momentum indicators present a mixed but generally constructive picture. The Relative Strength Index (RSI) reads 58, suggesting that gold remains in neutral territory with room for additional upside movement before reaching overbought conditions. The MACD indicator shows a slight bullish divergence, supporting the potential for continued price appreciation in the near term.

Chart patterns indicate a possible ascending triangle formation, with today’s price action testing the upper boundary of this pattern. A successful breakout above 4,240 USD could trigger a measured move toward 4,320-4,350 USD, representing significant upside potential for active traders positioning for momentum-driven moves.

Exit strategies for short-term traders should target the 4,230-4,240 USD resistance zone for partial profit-taking, while maintaining core positions for potential extension toward higher resistance levels. Executing a sale at these resistance points allows traders to lock in gains efficiently during intraday trading.

Intraday Trading Opportunities

Optimal entry points for today’s trading session exist on any pullbacks toward the 4,190-4,200 USD support zone, provided this level holds during testing. Risk management considerations suggest placing stop losses below 4,170 USD to protect against unexpected breakdown scenarios while maintaining reasonable risk-to-reward ratios.

Volume analysis reveals above-average participation during today’s early trading hours, indicating genuine institutional interest rather than retail-driven speculation. This volume profile supports the sustainability of current price levels and suggests that any upward breakout attempts would likely attract additional buying support.

Exit strategies for short-term traders should target the 4,230-4,240 USD resistance zone for partial profit-taking, while maintaining core positions for potential extension toward higher resistance levels. The relatively low volatility environment creates favorable conditions for range-trading strategies between established support and resistance boundaries.

Global Gold Market Activity Today

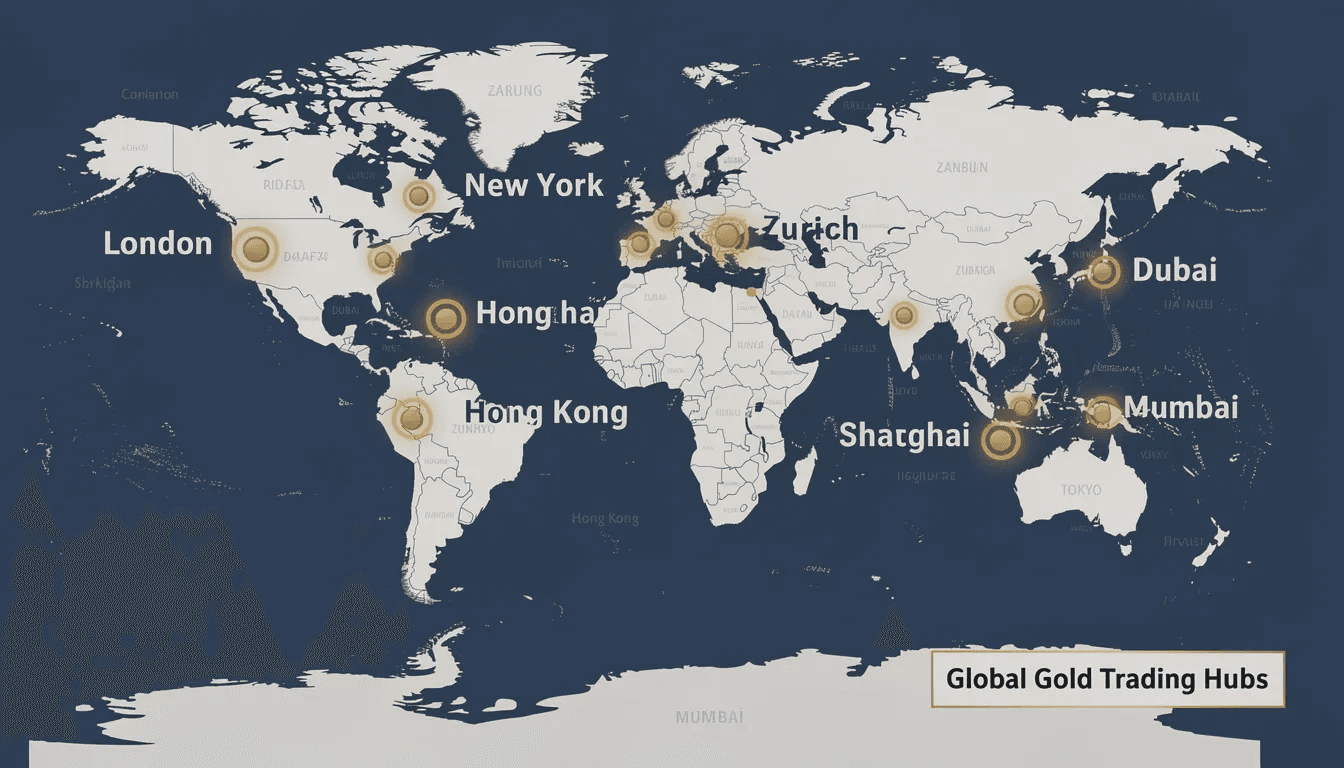

Asian market performance provided positive momentum heading into today’s European and US trading sessions. The Shanghai gold exchange showed strength overnight, with Chinese investors continuing to accumulate physical gold positions. Tokyo market activity remained steady, reflecting the ongoing appeal of gold among Japanese institutional investors seeking alternatives to low-yielding domestic bonds.

London bullion market association fixing prices established solid benchmarks for today’s European trading, with the morning fix supporting current spot price levels. European market trends during today’s session have been characterized by steady accumulation, with London-based precious metals dealers reporting consistent buying interest from both institutional and retail clients. Canada is also recognized as a significant gold trading center, with the Canadian market playing an important role in global gold price discovery.

New York Mercantile Exchange futures activity shows increased open interest in near-term gold futures contracts, particularly the February 2026 contract (GCG26) trading at 4,234.1 USD. The york mercantile exchange data indicates that institutional traders are positioning for continued strength in gold prices over the coming months. The USA is a primary location for gold bullion production, and a wide range of gold products are available within the United States.

ETF flows present a compelling picture of institutional sentiment, with major gold ETFs experiencing net inflows throughout recent trading sessions. These flows represent significant institutional capital allocation toward gold exposure, supporting the fundamental case for continued price appreciation. Live market platforms also provide real-time pricing for other precious metals such as palladium, which is increasingly important for diversified investment portfolios.

Mining company stock performance today reflects the positive sentiment in the broader gold market, with major gold mining stocks outperforming general market indices. This sector rotation into mining-related equities suggests that investors are positioning for continued strength in the underlying commodity.

Economic Events Affecting Gold Prices Today

Scheduled economic data releases include consumer price index figures and employment statistics that could materially impact Federal Reserve policy expectations. These inflation data points will provide crucial insights into the trajectory of monetary policy, with stronger-than-expected inflation potentially supporting gold’s appeal as an inflation hedge.

Federal Reserve officials’ speeches scheduled for today include remarks from key policymakers regarding future monetary policy directions. Any hints regarding interest rate policy or quantitative easing measures could significantly influence gold market sentiment and trading activity throughout the session.

International trade developments continue to influence currency market fluctuations, with ongoing trade discussions affecting dollar strength and, consequently, gold pricing dynamics. These currency values shifts create trading opportunities for astute gold market participants who understand the interconnected nature of international financial markets.

Corporate earnings reports from major mining companies provide insights into the gold industry’s operational efficiency and future production capacity. These reports influence investor sentiment toward gold-related equities and provide fundamental analysis supporting gold price projections.

Gold ETFs and Derivatives: Modern Investment Vehicles

In today's fast-evolving financial markets, gold ETFs (Exchange-Traded Funds) and derivatives have emerged as essential tools—no question about it. Investors seeking exposure to the gold market without the complexities of storing or insuring physical gold need these instruments. Period. These modern investment vehicles offer a streamlined way to participate in gold price movements, whether your goal is hedging against inflation, diversifying your portfolio, or capitalizing on short-term price activity. Smart money understands this.

Gold ETFs are traded on major exchanges such as the New York Mercantile Exchange—providing direct, uncompromising exposure to the spot gold price, which is determined by the London Bullion Market Association (LBMA). Each ETF share represents fractional ownership of gold bullion or gold coins held in secure vaults. No ambiguity here. This structure allows investors to buy and sell gold in physical form, using US dollars, Canadian dollars, Australian dollars, or other major currencies—all without the logistical nightmares of handling gold bars or coins.

Derivatives—including gold futures contracts and options—offer additional flexibility for those serious about trading gold based on future price expectations. Gold futures are standardized agreements to buy or sell specific amounts of gold, usually measured in troy ounces, at predetermined prices on set dates. These contracts trade actively on platforms like the York Mercantile Exchange, providing liquidity and profit potential in both rising and falling markets. Decisive traders thrive here.

The spot gold price serves as the definitive benchmark for both ETFs and derivatives—reflecting real-time gold pricing without compromise. This live gold price responds to global economic data, currency values, investment supply and demand, and geopolitical developments. During periods of heightened uncertainty or lower rates, gold prices often reach peak levels as investors seek the safe haven qualities of precious metals. Smart strategy recognizes these patterns.

Gold certificates offer another viable alternative—representing legal ownership of specified gold amounts without requiring physical delivery. These certificates, alongside gold ETFs, allow investors to gain gold market exposure while maintaining liquidity and trade efficiency. No storage headaches, maximum flexibility.

The key advantage of gold ETFs and derivatives? Accessibility—pure and simple. Investors can buy or sell these instruments anytime during market hours, tracking live gold prices and responding quickly to market shifts. This flexibility, combined with multi-currency trading capability and zero storage costs, makes gold ETFs and derivatives attractive options for both individual and institutional investors. Efficiency matters.

Gold ETFs and derivatives have revolutionized gold market access—that's the bottom line. By providing exposure to gold prices, whether measured in US dollars, Japanese yen, or other currencies, these instruments offer practical, cost-effective, and liquid means to participate in precious metals markets. As the gold market continues evolving, these modern vehicles will remain central to investment strategies focused on gold, silver, platinum, and other commodities—helping investors navigate today's complex global financial landscape with confidence and clarity.

Investment Strategies for Today’s Gold Market

Physical gold purchasing opportunities exist at current price levels, with dealers offering competitive premiums over spot prices. Gold coins from major mints remain readily available, while gold bullion products continue to attract investors seeking direct precious metal exposure. Coin ownership is an important way to diversify investment portfolios and secure tangible assets. The current price environment provides attractive entry points for long-term investors building core precious metals positions.

Fluctuations in jewelry demand, especially in major markets like India, can significantly influence gold prices and overall market trends.

When making a purchase, investors can easily buy gold at live market prices, benefiting from a straightforward and flexible process that allows for immediate or future acquisition. Gold investments also offer strong liquidity, enabling investors to quickly convert their holdings to cash through secure sales or redemptions.

Gold ETFs and mutual fund performance today has generally matched spot price movements, making these vehicles attractive for investors seeking gold exposure without physical storage concerns. Major gold ETFs continue to trade at minimal premiums to net asset value, ensuring efficient price discovery and liquidity for both institutional and retail participants.

Mining stock analysis reveals compelling valuations among major gold producers, with many companies trading at discounts to historical price-to-earnings ratios despite the strong gold price environment. This sector rotation opportunity allows investors to gain leveraged exposure to gold price movements while potentially benefiting from operational improvements and increased profitability.

Portfolio allocation recommendations suggest that current market conditions support increased precious metals weighting, particularly for investors seeking diversification from traditional equity and bond holdings. The combination of monetary policy uncertainty and geopolitical risks supports allocation percentages in the 5-15% range for most balanced portfolios.

Investment supply dynamics continue to favor gold accumulation, with central bank purchases and institutional demand providing fundamental support for prices. The limited supply of newly mined gold relative to investment demand creates a favorable supply-demand imbalance that supports higher price levels.

Short-term vs Long-term Outlook

Day trading considerations for today’s market focus on the established support and resistance levels, with opportunities existing for skilled traders who can capitalize on intraday volatility while managing risk appropriately. The current price environment offers sufficient movement for scalping opportunities while maintaining relatively predictable trading ranges.

Weekly and monthly trend implications based on today’s price action suggest continued bullish momentum, particularly if gold can maintain current levels above key support zones. The monthly gain of 7.04% demonstrates sustained buying pressure that typically indicates longer-term trend continuation.

Seasonal factors historically favor gold performance during the fourth quarter, with December typically showing strong performance as investors position portfolios for year-end and prepare for potential January buying. These seasonal patterns align with current technical and fundamental factors to support continued strength.

The combination of Federal Reserve policy uncertainty, international geopolitical risks, and strong institutional demand creates a compelling environment for gold investment across multiple timeframes. Whether pursuing short-term trading profits or building long-term wealth preservation positions, today’s gold market offers opportunities for informed participants who understand the complex dynamics driving precious metals valuations.

Current market conditions reflect a mature bull market in gold that shows little sign of exhaustion. The combination of monetary policy support, safe haven demand, and technical momentum suggests that today’s price levels may represent attractive accumulation opportunities rather than distribution zones. For investors seeking to buy gold or expand existing positions, current market dynamics provide a supportive environment for both immediate trading opportunities and longer-term investment strategies.

As the gold market continues to evolve throughout today’s trading session, maintaining awareness of key economic developments and technical levels will be crucial for optimizing investment outcomes in this dynamic and opportunity-rich market environment.