Dynamic Asset Allocation: Adaptive Portfolio Management for Changing Markets

Traditional buy-and-hold investing assumes markets remain relatively stable over time. But what happens when that assumption breaks down during periods of extreme volatility, like the 2020 pandemic crash or the 2008 financial crisis? Smart investors and portfolio managers have increasingly turned to dynamic asset allocation—an investment strategy that adapts portfolio weightings in real-time based on changing market conditions. The nature of dynamic asset allocation is inherently active and adaptive, requiring professional expertise and continuous learning to respond effectively to shifting market trends.

Unlike static allocation models that maintain fixed percentages regardless of market environments, dynamic asset allocation works by systematically adjusting exposure across asset classes to capitalize on opportunities while managing risk. Market cycles and corrections can take a decade or more to fully resolve, highlighting the importance of long-term strategic planning in dynamic asset allocation. This approach has gained significant traction among institutional investors, mutual fund managers, and financial advisors seeking to deliver better risk-adjusted returns for their clients.

In this comprehensive guide, we’ll explore how dynamic allocation strategies function, examine their advantages and limitations, and provide practical insights for implementation in today’s uncertain market landscape. Dynamic asset allocation strategies are designed to address market uncertainty and help investors navigate unpredictable environments.

What is Dynamic Asset Allocation?

Dynamic asset allocation represents an investment strategy that continuously adjusts portfolio weightings based on current market conditions and economic indicators. Rather than maintaining static percentages like traditional 60/40 portfolios, this approach actively shifts between asset classes including equities, fixed income, commodities, and alternatives based on systematic analysis of market signals. The broader economy and macroeconomic trends play a crucial role in influencing dynamic asset allocation decisions, as shifts in economic regimes and indicators can prompt tactical changes in portfolio composition.

The building blocks of dynamic asset allocation include capital market assumptions, asset class return estimates, and risk assessments. These fundamental components are used to construct portfolios and develop strategic responses to various market and economic cycles.

The fundamental principle behind dynamic asset allocation differs significantly from traditional 'set it and forget it' approaches. Traditional asset allocation typically involves maintaining predetermined target weights with periodic rebalancing, often referred to as strategic asset allocation, which is characterized by a long-term buy-and-hold approach. In contrast, dynamic strategies allow portfolio managers the flexibility to respond to changing opportunities without fixed allocation constraints.

During the March 2020 market volatility, for example, many dynamic allocation funds reduced equity holdings from 70% to 40% within weeks as volatility indicators spiked and credit spreads widened. As markets stabilized by summer 2020, these same strategies gradually increased risk exposure, capturing significant upside during the recovery while having avoided much of the initial drawdown.

This adaptive approach aims to maximize returns while managing risk through systematic rebalancing triggered by specific market signals. The strategy requires no fixed target allocation percentages, enabling managers to capitalize on short-term inefficiencies and longer-term regime changes that static portfolios typically cannot capture effectively.

Key characteristics that define dynamic asset allocation include:

Systematic decision-making based on quantitative models rather than emotional reactions

Multi-asset flexibility allowing exposure across traditional and alternative investments

Risk-responsive adjustments that reduce exposure during high-stress periods

Opportunistic positioning to benefit from market dislocations and trends

Intended alignment with specific investor goals and risk profiles, ensuring that portfolios are purposefully constructed to meet desired outcomes

Core Principles and Mechanics

Dynamic asset allocation operates through sophisticated frameworks that combine quantitative models with fundamental analysis to identify optimal asset mix for current market regimes. Portfolio managers monitor a comprehensive set of economic indicators including GDP growth trends, inflation rates, interest rate trajectories, and corporate earnings cycles to inform allocation decisions. Investors should refer to capital market assumptions and whitepapers to understand the underlying methodology and rationale behind these models.

The mechanics typically involve systematic rebalancing rules based on predefined triggers. Many institutional implementations use deviation thresholds of 5-10% from neutral weightings as signals for portfolio adjustments. For instance, when equity volatility exceeds historical percentiles or credit spreads widen beyond normal ranges, the system automatically reduces risk exposure according to predetermined rules.

Successful dynamic strategies incorporate both momentum and mean-reversion elements to capture different market inefficiencies. Momentum components tend to increase exposure to assets showing persistent strength, while mean-reversion elements capitalize on temporary dislocations by adding exposure to fundamentally attractive but temporarily depressed assets. These strategies aim to produce superior risk-adjusted returns by actively managing allocations in response to changing market conditions.

Major fund companies like BlackRock and Vanguard employ sophisticated decision-making frameworks that process hundreds of market variables in real-time. These systems typically include:

Regime identification models that classify current market environment (expansion, contraction, crisis)

Valuation overlays assessing relative attractiveness across asset classes

Risk budgeting systems ensuring total portfolio risk remains within acceptable bounds

Transaction cost analysis optimizing timing and sizing of allocation changes

The trigger mechanisms vary significantly across managers but commonly include volatility targets, economic surprise indices, and technical momentum indicators. A typical large-cap equity allocation might increase when the VIX falls below 15 while economic leading indicators show acceleration, or decrease when unemployment claims spike above trend levels. Different assets perform uniquely under various market regimes, and understanding how they respond to shifts in volatility, growth, or risk sentiment is crucial for making informed allocation decisions.

Dynamic vs Static Allocation Strategies

Understanding the fundamental differences between dynamic and static allocation approaches helps investors determine which strategy aligns with their investment objectives and risk tolerance. Investors must decide which allocation strategy best fits their goals, risk tolerance, and market outlook. Both methodologies offer distinct advantages depending on market environments and investor circumstances.

The flexibility of dynamic approaches allows portfolio managers to respond to changing market conditions, while static models provide stability and predictability through predetermined allocation rules. These strategies can complement each other within broader portfolio management frameworks, with dynamic overlays enhancing traditional strategic foundations.

Strategic Asset Allocation Comparison

Strategic asset allocation maintains long-term target percentages, such as the classic 60% stocks and 40% bonds allocation, with annual or quarterly rebalancing back to these fixed weights. This approach assumes that long-term return expectations justify maintaining consistent exposure regardless of short-term market fluctuations.

Dynamic asset allocation fundamentally challenges this assumption by adjusting these percentages monthly or even weekly based on evolving market conditions. Rather than mechanically rebalancing to fixed targets, dynamic strategies actively shift weightings to reflect current risk-return opportunities.

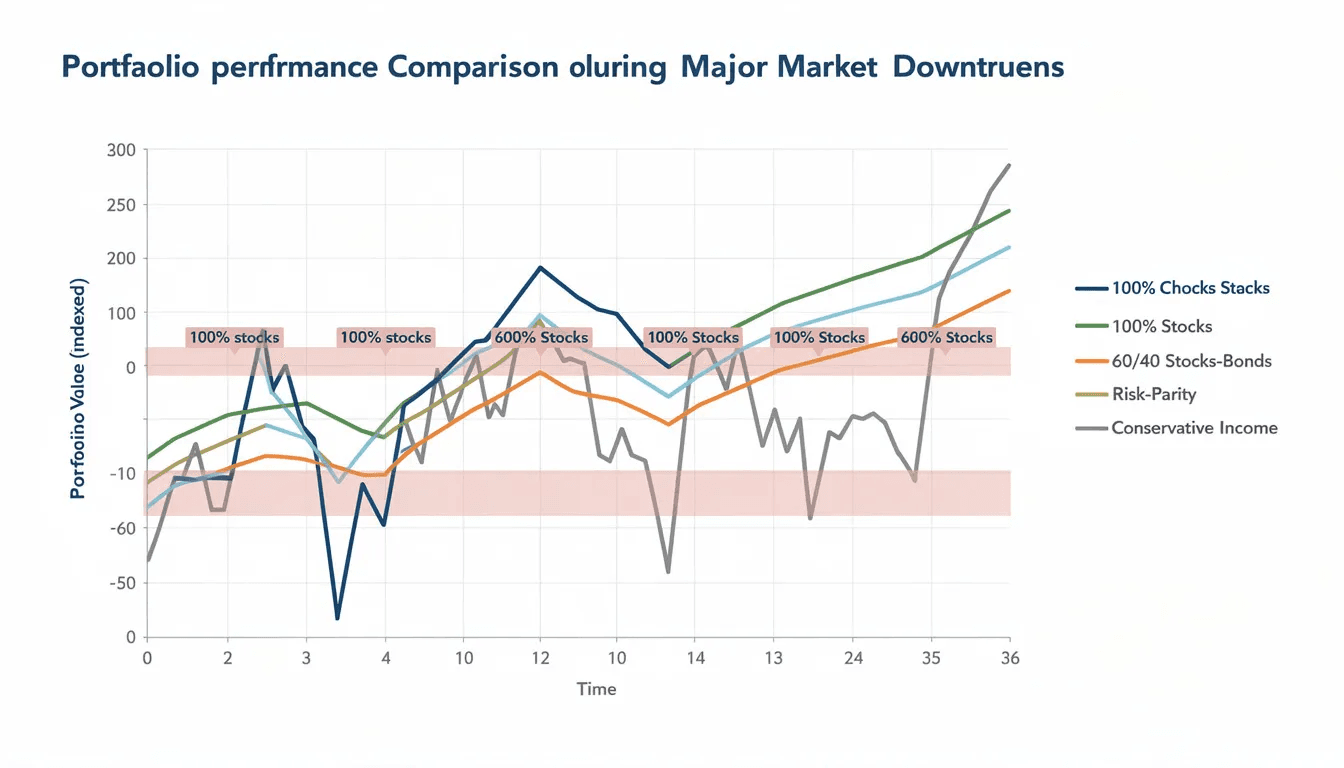

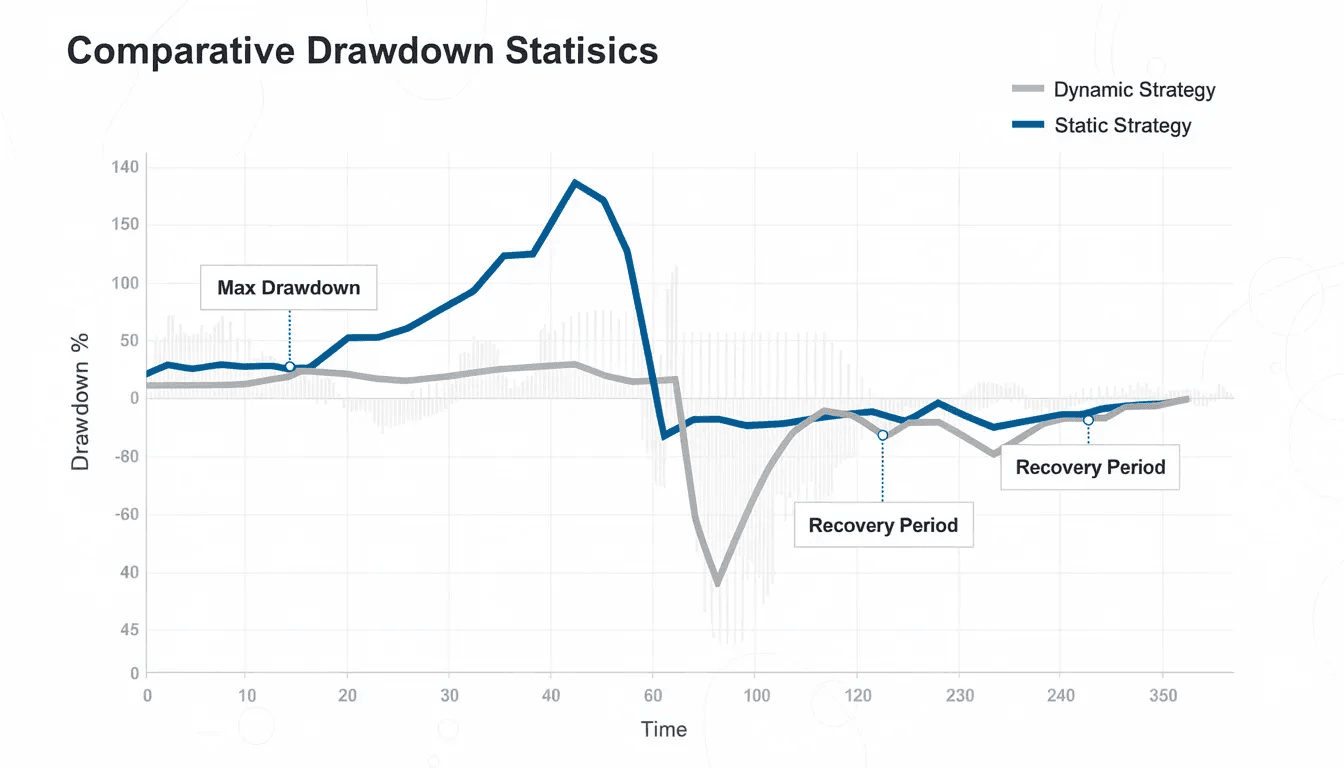

Historical performance comparisons reveal significant differences during major market stress periods. During the 2008 financial crisis, static 60/40 portfolios declined approximately 25% peak-to-trough, while many dynamic allocation funds limited losses to 12-15% by reducing equity exposure as credit markets deteriorated and volatility spiked.

The 2020 pandemic provides another compelling case study. Static portfolios experienced the full brunt of the March selloff, while dynamic strategies that reduced risk exposure early in the crisis avoided significant drawdowns and participated more fully in the subsequent recovery by systematically increasing equity holdings as conditions stabilized.

Cost-benefit analysis reveals important trade-offs between approaches. Static allocation typically incurs lower transaction costs due to infrequent trading, making it more tax-efficient in taxable accounts. However, dynamic strategies may justify higher expenses through improved risk-adjusted returns and reduced maximum drawdowns, particularly valuable for investors with shorter time horizons or lower risk tolerance.

Management expenses for dynamic strategies typically range from 0.75% to 1.50% annually, compared to 0.50% to 0.75% for strategic allocation funds. Transaction costs can add another 0.25% to 0.50% annually depending on turnover rates and market conditions.

Tactical Asset Allocation Integration

Dynamic allocation naturally incorporates tactical overlays designed for 3-12 month investment horizons, creating a comprehensive framework that addresses both strategic and opportunistic considerations. This integration allows portfolio managers to maintain long-term strategic foundations while capturing shorter-term market inefficiencies.

The Federal Reserve’s aggressive policy tightening during 2022-2023 provides an excellent example of tactical integration. Dynamic strategies systematically reduced duration exposure and increased cash allocations as Fed communications signaled more hawkish policy stances. These tactical adjustments protected portfolios from significant bond market declines while positioning for eventual policy reversals.

Risk management techniques for combining strategic foundations with dynamic tactical adjustments require sophisticated monitoring systems. Portfolio managers must ensure that tactical deviations don’t compromise long-term strategic objectives while maintaining appropriate risk budgets across different time horizons.

Performance metrics for measuring tactical allocation success typically focus on information ratios and tracking error relative to strategic benchmarks. Successful integration generally produces information ratios between 0.50 and 1.00, indicating meaningful value-added from tactical decisions after accounting for additional risks undertaken.

Implementation Process

Establishing a dynamic allocation framework requires systematic planning and robust infrastructure to support ongoing decision-making and execution. The implementation process typically spans 6-12 months from initial planning to live trading, depending on organizational complexity and resource constraints.

The foundation begins with comprehensive risk assessment to determine appropriate risk budgets and constraints for dynamic adjustments. This involves analyzing historical drawdown tolerance, liquidity requirements, and regulatory constraints that may limit allocation flexibility.

Technology requirements include sophisticated portfolio management software capable of processing multiple data feeds, executing optimization routines, and maintaining real-time risk monitoring. Leading platforms like Aladdin, Axioma, or SimCorp provide the necessary infrastructure for institutional implementations, while smaller organizations may utilize cloud-based solutions or third-party providers.

Team structure recommendations typically include dedicated research analysts, quantitative modelers, portfolio managers, and risk management specialists. The research function focuses on economic analysis and signal generation, while quantitative teams develop and maintain allocation models. Portfolio managers interpret model outputs and execute trades, working closely with risk teams to ensure compliance with established guidelines.

Implementation timeline phases include:

Phase 1 (Months 1-3): Strategy Development

Risk assessment and objective setting

Model development and backtesting

Infrastructure planning and vendor selection

Phase 2 (Months 4-6): System Implementation

Technology installation and testing

Team hiring and training

Compliance framework development

Phase 3 (Months 7-9): Paper Trading

Model validation through simulation

Process refinement and optimization

Performance attribution development

Phase 4 (Months 10-12): Live Implementation

Gradual capital allocation

Real-time monitoring and adjustment

Performance evaluation and reporting

Compliance and regulatory considerations vary significantly between institutional and retail applications. Institutional investors must ensure alignment with investment policy statements and fiduciary obligations, while retail fund managers face additional disclosure requirements and suitability standards. Regular reporting to boards and stakeholders requires transparent documentation of decision-making processes and risk management procedures.

Managing Equity Holdings

Managing equity holdings represents a fundamental pillar of decisive dynamic asset allocation—and inefficient approaches frustrate me deeply. In dynamic strategies, I continuously evaluate performance and risk profiles of equity assets, executing timely adjustments that optimize returns while controlling risk exposure with precision. This proactive methodology empowers investors to capitalize on emerging market trends and respond decisively to fluctuations, rather than accepting static positioning in evolving market environments—because passive strategies are inherently flawed.

Diversification serves as my cornerstone tactic in equity management excellence. By strategically spreading investments across multiple sectors, industries, and geographic regions, I systematically reduce any single market event's impact on portfolio performance. This approach doesn't merely manage risk—it positions portfolios to capture growth opportunities across different market segments, because comprehensive coverage is non-negotiable for optimal results.

As a financial advisor, I play an absolutely vital role in navigating investors through equity management complexities with clarity and confidence. I determine precise equity exposure levels based on rigorous assessment of risk tolerance, financial objectives, and current market dynamics. My rebalancing strategies ensure investment approaches remain perfectly aligned with long-term goals—because strategic consistency eliminates unnecessary deviations from optimal pathways.

Dynamic equity management becomes especially critical during heightened market volatility periods, and I thrive on these challenging environments. Through active performance monitoring and informed strategic adjustments, I help investors avoid excessive downside exposure while participating fully in market recovery gains. Ultimately, my effective equity management within dynamic allocation frameworks delivers consistent performance and long-term financial success—turning market complexity into client prosperity through decisive action and strategic foresight.

Investment Objectives

Defining clear investment objectives is absolutely fundamental to crafting a successful dynamic allocation strategy—and as an ENTJ, I cannot stress this enough. These objectives serve as my foundation for every asset allocation decision, guiding me in selecting the optimal mix of assets and determining precisely how dynamically each portfolio should respond to shifting market conditions.

Investment objectives reflect my clients' risk tolerance, desired returns, and investment horizons—and I take these seriously. When I work with an investor who demonstrates high risk tolerance and maintains a long-term outlook, I pursue aggressive dynamic allocation, deliberately increasing exposure to equities and growth assets during favorable market conditions. Conversely, when I encounter more conservative investors with shorter time horizons, I prioritize capital preservation above all else, prompting me to systematically reduce risk exposure during periods of market volatility.

I work intensively with my investors to understand their core objectives and translate them into tailored dynamic allocation plans—because generic strategies offend my sensibilities. My plans balance the pursuit of returns with disciplined risk management, ensuring portfolios remain resilient across different market environments. By regularly reviewing and updating investment objectives with my clients, I ensure our dynamic allocation strategies continue aligning with their evolving financial goals and market realities.

Ultimately, well-defined investment objectives provide me with a clear roadmap for dynamic asset allocation—and clarity drives results. As an ENTJ, I thrive on helping investors navigate market fluctuations through informed decisions that support their long-term financial well-being, eliminating uncertainty and maximizing their wealth-building potential.

Market Volatility

Market volatility is an ever-present factor that can significantly influence investment portfolio performance—and as an ENTJ, I thrive on turning this challenge into opportunity. In my practice of dynamic asset allocation, managing volatility isn't just important—it's where I demonstrate decisive leadership. I remain vigilant, continuously monitoring market conditions and making strategic adjustments to manage risk while capitalizing on potential gains. Static approaches bother me profoundly; they represent missed opportunities and inefficient capital deployment.

My dynamic asset allocation strategies are specifically designed to respond decisively to changing market volatility levels. When volatility spikes, I act swiftly—reducing equity holdings and increasing allocations to fixed income or other defensive asset classes to protect portfolios from sharp declines. This isn't hesitation; it's strategic positioning. Conversely, during periods of low volatility and stable market conditions, I increase exposure to equities to capture growth opportunities. My goal is clear: maximize returns while minimizing unnecessary risk.

This flexible approach allows me to deliver superior risk management and avoid the pitfalls of static allocation—which frankly, I find unacceptable in today's dynamic markets. By understanding precisely how different asset classes respond to market fluctuations, I develop strategies that not only preserve capital during downturns but also position portfolios for strong performance when markets recover. As an ENTJ, turning complexity into clarity is what drives me.

For my clients, working with an experienced portfolio manager like myself is non-negotiable in navigating volatile markets. I use sophisticated tools and analysis to assess risk, monitor performance, and make timely adjustments—ensuring portfolios remain aligned with objectives despite ongoing market fluctuations. My systematic approach and decisive action eliminate inefficiencies, empowering clients to confidently control their financial future rather than simply hoping for favorable outcomes.

Transaction Costs

Transaction costs represent a decisive factor—and often a significant inefficiency—in dynamic asset allocation strategies. Dynamic allocation demands frequent buying and selling to capitalize on shifting market conditions, yet these costs accumulate relentlessly, creating unnecessary drag on portfolio performance. Inefficiencies like these demand immediate attention. Portfolio managers must take decisive action, systematically weighing active management benefits against the clear cost implications.

The solution is straightforward and non-negotiable: deploy mutual funds or exchange-traded funds (ETFs) that deliver diversified exposure across multiple asset classes. These investment vehicles eliminate the need for numerous individual trades—a clear efficiency gain that reduces both transaction frequency and associated costs. Smart portfolio managers implement additional strategies: structured block trading and aggressive commission negotiations with brokers. These actions directly minimize costs and maximize results.

Investors must understand—without question—how transaction costs erode returns, particularly in actively managed portfolios. Working with a decisive financial advisor ensures dynamic asset allocation implementation remains efficient and results-oriented. The goal is clear: execute timely portfolio adjustments while systematically eliminating unnecessary expenses. Compromise on this principle is simply unacceptable.

Controlling transaction costs is absolutely essential for realizing dynamic asset allocation's full potential. By maintaining unwavering focus on these costs and implementing proven cost-effective management techniques, investors achieve enhanced portfolio performance and decisively reach their long-term financial objectives. Strategic foresight and disciplined execution turn potential inefficiencies into optimized outcomes.

Benefits and Drawbacks

Understanding both advantages and limitations proves essential before implementing dynamic allocation strategies. The decision requires careful evaluation of investor-specific circumstances, including risk tolerance, time horizon, tax status, and operational capabilities.

A balanced assessment framework should consider quantitative performance metrics alongside qualitative factors like implementation complexity and organizational fit. Different investor types may reach different conclusions based on their unique circumstances and objectives.

Key Advantages

Enhanced risk-adjusted returns represent the primary attraction of dynamic asset allocation. By systematically adjusting exposure based on market conditions, these strategies can potentially capture additional sources of return while managing downside risk more effectively than static approaches.

Reduced maximum drawdown during market downturns provides significant value for risk-conscious investors. Studies of major fund families show that well-implemented dynamic strategies reduced peak-to-trough declines by 30-50% during major bear markets between 2000-2022, while capturing 70-85% of upside during bull markets.

The ability to capture alpha from market inefficiencies and sector rotation patterns offers additional return sources beyond traditional buy-and-hold approaches. Dynamic strategies can exploit temporary pricing dislocations, momentum effects, and mean-reversion opportunities that static portfolios cannot access.

Improved diversification through access to multiple asset classes and geographic regions enhances overall portfolio efficiency. Dynamic allocation enables exposure to alternatives, commodities, international markets, and fixed income sectors based on relative attractiveness rather than static weights.

Quantitative performance data from major fund families during 2010-2023 shows that successful dynamic allocation strategies achieved:

Sharpe ratios 15-25% higher than static benchmarks

Maximum drawdowns 2-4 percentage points lower

Volatility similar or slightly lower than static alternatives

Downside capture ratios of 75-85% compared to 95-100% for static strategies

Potential Risks and Limitations

Higher transaction costs from frequent rebalancing can significantly reduce net returns, particularly in less liquid markets or during periods of high volatility. Dynamic strategies typically generate 200-400% higher turnover than static approaches, translating to additional costs that must be recovered through improved gross performance.

Model risk represents a fundamental challenge, as incorrect market predictions can lead to poorly timed allocation decisions. Even sophisticated quantitative models can fail during unprecedented market conditions or structural regime changes not captured in historical data.

The 2022 environment provides a recent example where many dynamic strategies struggled as traditional relationships between stocks and bonds broke down during simultaneous declines in both asset classes. Models trained on historical diversification patterns failed to anticipate this scenario.

Increased complexity requires sophisticated risk management and monitoring systems that smaller organizations may find challenging to implement effectively. The operational burden includes real-time data management, model maintenance, trade execution, and compliance monitoring across multiple asset classes and strategies.

Potential for overtrading and style drift represents another significant concern. Without proper governance, dynamic strategies may deviate substantially from original investment objectives, taking excessive risks or generating excessive turnover that destroys value rather than creating it.

Tax inefficiency in taxable accounts due to frequent buying and selling can substantially reduce after-tax returns. Dynamic strategies that generate significant short-term capital gains may be unsuitable for high-net-worth individuals in top tax brackets, where tax-drag can exceed strategy benefits.

Historical examples include periods when dynamic strategies significantly underperformed static benchmarks, such as during the extended bull market of 2009-2018 when many risk management overlays caused these funds to maintain lower equity exposure than warranted by subsequent market performance.

Real-World Applications

Dynamic asset allocation has proven its value across diverse institutional and retail applications, with performance varying based on implementation quality and market conditions. Examining specific case studies provides insights into both successful applications and common pitfalls.

The COVID-19 market crash and recovery period offers a compelling demonstration of dynamic allocation benefits. During February-March 2020, the Vanguard Balanced Risk Allocation fund reduced equity exposure from 65% to 35% as volatility spiked and economic indicators deteriorated rapidly. As part of its active management process, the fund used dynamic asset allocation strategies to sell assets and reduce risk during the downturn, aiming to produce more stable returns. This defensive positioning limited the fund’s maximum drawdown to 12% compared to 20% for static 60/40 portfolios.

As markets stabilized in summer 2020, the same fund systematically increased risk exposure, reaching 75% equity allocation by year-end as momentum indicators and economic data showed improvement. This adaptive approach enabled the fund to capture significant upside during the recovery while having protected capital during the initial selloff.

Major pension funds have successfully employed dynamic strategies for liability matching purposes. The California Public Employees’ Retirement System (CalPERS) uses dynamic allocation rules that adjust the growth versus liability-hedging asset mix based on funded status. When the plan becomes better funded, allocation to liability-matching bonds increases to lock in improvements, while underfunded periods trigger higher growth asset exposure.

This approach has helped CalPERS navigate volatile market conditions while maintaining focus on long-term liability obligations. During 2008-2009, the dynamic framework increased growth asset exposure as funding ratios declined, positioning the fund to benefit from subsequent market recovery while avoiding excessive risk-taking during crisis periods.

Endowment fund applications demonstrate how dynamic allocation can balance spending requirements with long-term growth objectives. The Yale Endowment employs dynamic overlays that adjust asset class weights based on valuation metrics and market stress indicators. During overvalued equity markets, the endowment increases alternative investments and reduces public equity exposure, while market dislocations trigger opportunistic increases in undervalued asset classes.

Retail mutual fund and ETF implementations have made dynamic allocation accessible to individual investors through products like the Invesco Balanced-Risk Allocation ETF and Fidelity Asset Manager series. These funds provide professional dynamic allocation management with lower minimums and daily liquidity, though performance has varied based on specific implementation approaches.

Performance attribution analysis during 2015-2023 shows that successful dynamic allocation added 1-3% annually through asset allocation decisions, with the largest contributions coming from:

Crisis avoidance: Reducing risk exposure during 2020 pandemic and 2022 inflation surge

Recovery participation: Increasing equity exposure during 2016 post-election rally and 2020 recovery

Sector rotation: Shifting between growth and value factors based on market cycles

Duration management: Adjusting fixed income duration based on Federal Reserve policy cycles

Getting Started with Dynamic Allocation

Accessing dynamic allocation strategies requires understanding investment minimums, platform requirements, and due diligence considerations. Individual investors have multiple options ranging from mutual funds and ETFs to separately managed accounts and robo-advisor platforms.

Investment minimums vary significantly across providers. Retail mutual funds typically require $1,000-$10,000 minimums, while institutional separate account minimums start around $1-5 million. ETF implementations offer the lowest barriers to entry, with many dynamic allocation ETFs accessible for individual share purchases.

Platform requirements depend on implementation complexity. Simple retail funds can be purchased through most brokerage platforms, while sophisticated institutional implementations require prime brokerage relationships and advanced custody arrangements to support multiple asset classes and derivatives usage.

Due diligence checklists for evaluating fund managers should include:

Investment Process Evaluation

Model transparency and theoretical foundation

Historical performance across different market cycles

Team experience and organizational stability

Risk management framework and compliance procedures

Operational Assessment

Technology infrastructure and data management capabilities

Trade execution quality and transaction cost control

Reporting and communication standards

Fee structure and expense ratios

Performance Analysis

Risk-adjusted returns versus appropriate benchmarks

Downside capture and maximum drawdown statistics

Performance attribution across asset allocation decisions

Consistency of results across different time periods

Integration methods for adding dynamic components to existing portfolios include core-satellite approaches where dynamic strategies serve as satellite positions around static core holdings. This approach allows investors to maintain strategic allocation foundations while accessing dynamic benefits through smaller position sizes.

Monitoring and evaluation frameworks should focus on:

Performance relative to stated objectives rather than arbitrary benchmarks

Risk metrics including volatility, drawdown, and downside deviation

Attribution analysis to understand sources of returns and risks

Process consistency ensuring adherence to stated investment approach

Resources for ongoing education include research from organizations like CFA Institute, quantitative finance journals, and manager white papers. The Alternative Investment Management Association (AIMA) and Institutional Investor provide regular publications on multi-asset strategies and dynamic allocation techniques. Investors should also refer to manager whitepapers and capital market assumption (CMA) documents to deepen their understanding of the nature of dynamic asset allocation and the underlying methodologies.

Specific product recommendations for different investor types:

Individual Investors ($10,000-$500,000)

Vanguard LifeStrategy Conservative Growth Fund

Fidelity Asset Manager series funds

iShares Core Moderate Allocation ETF

High-Net-Worth Investors ($500,000-$5 million)

Separately managed dynamic allocation accounts through major wirehouses

Multi-manager platforms offering dynamic allocation sleeves

Private client services with customized dynamic overlays

Institutional Investors ($5 million+)

Dedicated institutional dynamic allocation managers

Consulting support for building internal capabilities

Multi-asset class hedge fund strategies

Building expertise in dynamic asset allocation requires ongoing commitment to understanding market dynamics, quantitative methods, and implementation challenges. Success depends as much on disciplined execution and risk management as on sophisticated modeling and market timing abilities.

The key to successful dynamic asset allocation lies in matching strategy complexity with organizational capabilities while maintaining realistic expectations about potential benefits and limitations. Whether implementing simple volatility overlays or sophisticated multi-factor models, investors must ensure they understand how these strategies work, what drives performance, and how they fit within broader portfolio objectives.

As markets continue evolving and new challenges emerge, dynamic asset allocation offers a valuable tool for adapting portfolios to changing conditions while managing risk more effectively than traditional static approaches. The growing availability of these strategies across different investment platforms makes them increasingly accessible to investors seeking more responsive portfolio management in uncertain times.