Difference Between Gold and Silver

Gold and silver have captivated humanity for thousands of years, serving as currency, symbols of wealth, and materials for beautiful jewelry. But beyond their shared status as precious metals, these two elements differ significantly in ways that matter for your wallet, your jewelry box, and your investment portfolio.

In this guide, we’ll break down everything you need to know about the difference between gold and silver—from their atomic structures to their roles in modern technology and finance. Whether you’re shopping for an engagement ring, considering a long term investment, or simply curious about these fascinating metals, you’ll find practical insights to inform your decisions.

Key Differences Between Gold and Silver (Quick Summary)

So what is the difference between gold and silver? In simple terms, gold is a denser, more chemically stable yellow metal that primarily serves as a store of value, while silver is a lighter, more reactive white metal with significant industrial applications alongside its monetary role.

Here are the most important factors and contrasts at a glance:

Color: Gold displays its characteristic warm yellow hue; silver presents a bright white color with high reflectivity

Price per ounce: Gold trades in the thousands of dollars per ounce; silver trades in the tens of dollars—making gold the far more expensive metal

Rarity: Gold is approximately 60 times scarcer than silver in the Earth’s crust

Primary use: Gold functions mainly as a store of value and safe-haven asset; silver serves as a hybrid industrial metal and monetary metal

Investment role: Gold acts as the primary hedge against inflation and economic uncertainty; silver offers higher volatility with potential upside tied to manufacturing demand

Gold is significantly denser (around 19.3 g/cm³) compared to silver (about 10.5 g/cm³), meaning a gold bar feels nearly twice as heavy as a same-size silver bar. Gold also resists corrosion and tarnishing indefinitely, while silver reacts with sulfur compounds in air, developing a blackish patina over time.

Your choice between these two precious metals depends on your budget, risk tolerance, and whether you prioritize stability (gold) or potential upside linked to industrial demand (silver).

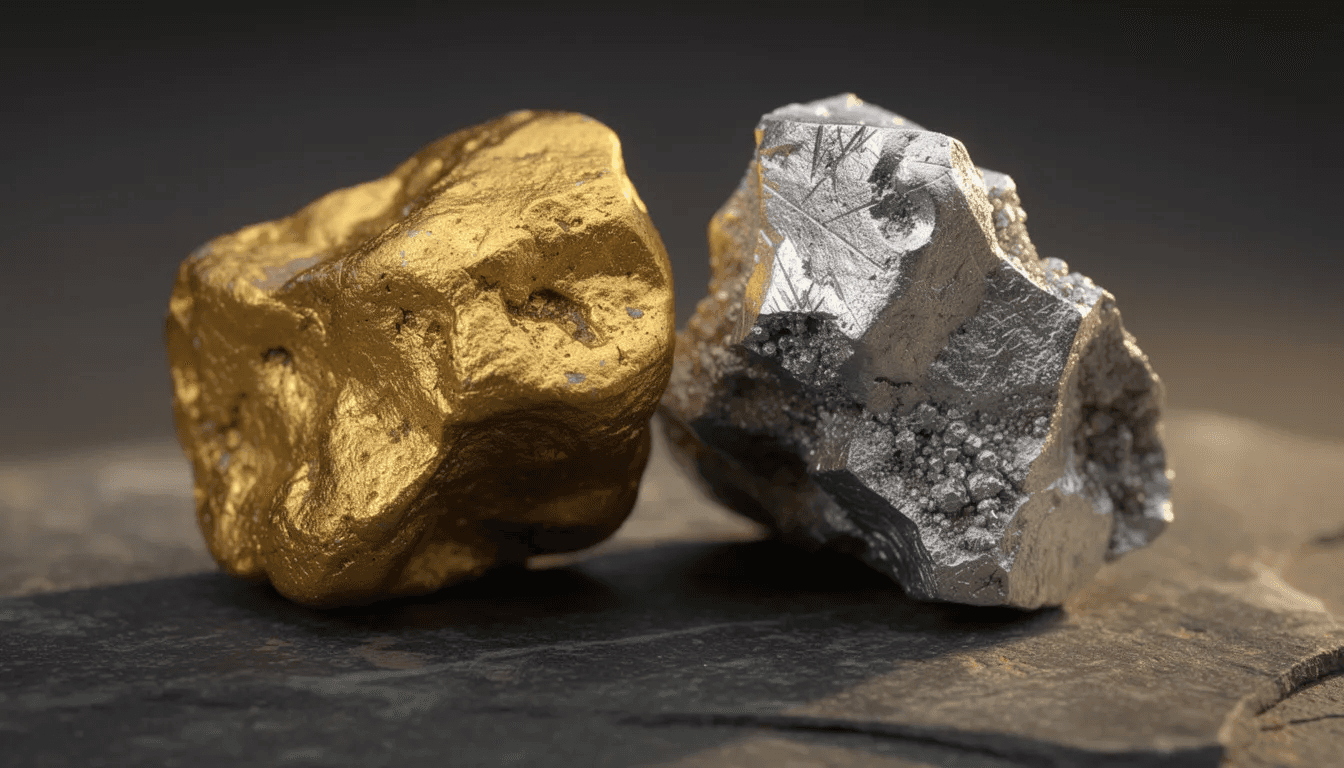

Basic Properties: What Are Gold and Silver?

Both gold and silver qualify as precious metals—defined by their scarcity, natural luster, and centuries-long role in monetary systems. However, they occupy different positions on the periodic table and behave differently in the market.

Gold (Au):

Atomic number 79, symbol Au (from Latin aurum)

Naturally occurring yellow metal with a deep, warm hue

Extremely dense at 19.32 g/cm³

Highly malleable—can be hammered into sheets thinner than one micron

Exceptionally resistant to corrosion, oxidation, and chemical attack

Features a single stable isotope (gold-197)

Silver (Ag):

Atomic number 47, symbol Ag (from Latin argentum)

Bright white metal with the highest reflectivity of any element

Density of 10.49 g/cm³—roughly half that of gold

Excellent electrical and thermal conductivity—the best of any metal

Prone to tarnishing when exposed to sulfur compounds in air

Contains two primary isotopes (silver-107 and silver-109)

Both metals occur naturally in ore deposits and as native metal, but their mining sources differ. Pure gold typically comes from dedicated gold mines, while silver is often extracted as a by-product of copper, lead, and zinc mining operations.

These fundamental physical and chemical traits explain why gold and silver play such distinct roles in jewelry, technology, and finance.

Chemical and Physical Differences

Understanding the physical science behind these two metals helps explain their everyday uses and long-term durability.

Density

The density difference between gold and silver is immediately noticeable when you hold them:

Gold: ~19.3 g/cm³

Silver: ~10.5 g/cm³

This means a one-ounce gold coin is physically much smaller than a one-ounce silver coin. For investors, this translates to gold requiring far less storage space for equivalent value—a practical consideration when accumulating significant holdings.

Hardness and Strength

Both metals rank similarly on the Mohs hardness scale:

Gold: approximately 2.5

Silver: approximately 2.5

In practice, both pure metals are quite soft and require alloying with other metals like copper or nickel to achieve the durability needed for jewelry and coins. Silver alloys can feel slightly stiffer, but the difference is minimal.

Reactivity

Here’s where the two metals diverge significantly:

Gold: Exceptionally chemically stable—does not rust, tarnish, or corrode in air or water. Only dissolves in aqua regia (a mixture of nitric and hydrochloric acids).

Silver: More reactive—forms black silver sulfide when exposed to sulfur compounds in the atmosphere. This tarnishing is cosmetic and can be polished away.

Conductivity

Silver: The most electrically and thermally conductive metal known, making it indispensable for electronics and solar technology

Gold: Slightly less conductive but far more stable over decades, preferred for high-reliability connectors in aerospace and medical devices

Unique Traits of Gold

Gold stands apart as the ultimate precious metal in terms of perceived value and monetary significance. Its unique properties have made it humanity’s preferred store of wealth for millennia.

Exceptional malleability and ductility: A single gram of gold can be beaten into a sheet covering nearly one square meter, or drawn into a wire over two kilometers long. This makes gold leaf possible for gilding art, architecture, and even gourmet cuisine.

Unmatched corrosion resistance: Gold does not tarnish, rust, or corrode under any normal conditions. Jewelry, coins, and artifacts retain their original luster across centuries—even millennia.

Distinctive color and symbolism: The warm yellow hue of the yellow metal has symbolized wealth, power, and achievement across virtually every culture. This association continues to drive demand for luxury items, gold jewelry, and fine jewelry.

Biocompatibility: Gold’s non-reactive nature makes it safe for contact with human tissue. It has been used in dental work for thousands of years and appears in modern medical implants and electronic devices that must function in harsh biological environments.

Unique Traits of Silver

Silver costs less than gold and reacts more readily with its environment, but it offers unmatched reflectivity and conductivity that make it irreplaceable in many applications.

Tarnishing behavior: Silver reacts with sulfur compounds in the air to form silver sulfide—the blackish coating you see on old silverware. While cosmetically undesirable, tarnish doesn’t damage the metal and polishes away easily.

Supreme reflectivity: Fine silver reflects approximately 95% of visible light—more than any other metal. This property makes silver essential for high-quality mirrors, telescope optics, and certain solar energy technologies.

Leading electrical and thermal conductivity: Silver conducts electricity and heat better than any other element, including copper and gold. This positions it as critical for electronics, switches, and high-performance components.

Antibacterial properties: Silver ions disrupt bacterial cell membranes, killing microbes on contact. Modern applications include wound dressings, antimicrobial coatings for medical devices, and specialty fabrics.

Industrial Uses: Where Gold and Silver Show Up in Everyday Life

Silver dominates industrial demand among precious metals, with over 50% of annual consumption coming from manufacturing sectors. Silver's demand is heavily influenced by its industrial applications and is more sensitive to changes in the global economy compared to gold. Gold’s industrial share remains below 10%, concentrated in specialized applications where reliability justifies the higher price.

Major Industrial Uses of Silver

Electronics: Circuit boards, switches, contacts, and conductive pastes rely on silver’s unmatched conductivity

Photovoltaics: Solar panels consume approximately 10% of annual silver supply—a figure projected to rise 20% annually through 2030 as renewable energy expands

Automotive: Modern vehicles contain numerous silver components in electrical systems and sensors

Chemical catalysts: Silver catalyzes production of ethylene oxide, formaldehyde, and other industrial chemicals

Medical products: Antibacterial silver appears in wound dressings, catheters, and surgical instruments

Specialty coatings: Mirrors, reflective films, and anti-fog treatments leverage silver’s optical properties

Industrial Uses of Gold

High-reliability electronics: Bonding wires, connectors, and contacts in aerospace, telecommunications, and medical devices where decades of corrosion-free performance is essential

Specialty glass: Gold coatings on architectural glass reflect infrared radiation, reducing cooling costs

Dentistry: Gold alloys for crowns, bridges, and fillings remain popular despite alternative materials

Medical equipment: Components requiring biocompatibility and extreme durability

One key difference: silver is often “used up” in dispersed industrial applications where recovery isn’t economically viable, while gold’s high value ensures most industrial gold gets recycled.

Jewelry and Aesthetics: Choosing Gold vs Silver

Both gold and silver remain staples in jewelry, but they differ in appearance, durability, and maintenance requirements.

Gold Alloys

Pure gold (24K) is too soft for everyday jewelry. Common alloys include:

18K gold: 75% gold, excellent balance of purity and durability

14K gold: 58.3% gold, more durable and affordable

Yellow gold: Alloyed with copper and silver to maintain warm tones

White gold: Mixed with palladium, nickel, or other white metals for a silvery appearance

Rose gold: Higher copper content creates pink-red hues

Silver in Jewelry

Sterling silver: 92.5% silver alloyed with 7.5% copper (and sometimes zinc) for strength—the standard for silver jewelry

Fine silver: 99.9% pure, too soft for most jewelry but used in certain applications

Key Comparisons

Factor | Gold | Silver |

|---|---|---|

Appearance | Warm yellow, white, or rose tones | Cool bright white color |

Best skin tone | Warm undertones | Cool undertones (though mixing metals is fashionable) |

Durability | Well-alloyed gold (14K-18K) resists wear | Sterling silver scratches more easily |

Maintenance | Minimal—retains color and shine | Requires periodic polishing to prevent tarnish |

Price | Significantly higher | More accessible budget-wise |

Gold vs Silver for Engagement Rings and Fine Jewelry

Metal choice matters significantly for pieces worn daily, like engagement rings or wedding bands.

Gold for engagement rings:

18K or 14K gold (yellow, white, or rose gold) offers the ideal balance of purity, durability, and symbolism

Resists tarnish and maintains appearance through decades of daily wear

Higher perceived prestige and resale value

White gold provides a platinum-like appearance at lower cost

Silver for engagement rings:

Pure silver or sterling silver is rarely chosen for high-end engagement rings due to softness and tarnishing

May work for budget-conscious couples or fashion-forward designs

Prongs and shanks can wear down faster, risking gemstones loosening

Lower perceived prestige compared to gold or platinum

Allergy considerations:

Some white gold alloys contain nickel, which can irritate sensitive skin

Sterling silver may include trace nickel or other metals

Hypoallergenic alternatives include palladium white gold or nickel-free sterling silver

Gold vs Silver as Investments

Both gold and silver function as investment assets and portfolio hedges, but they behave quite differently in practice. Many people choose to invest in gold and silver as a way to diversify their portfolios and hedge against economic uncertainty.

Gold’s Investment Role

Long history as a global store of value and reserve asset

Central banks hold substantial gold reserves—purchases exceeded 1,000 tonnes annually in recent years

Tends to be less volatile than silver, providing stability during financial crises

Consistently uncorrelated with other major asset classes like stocks and bonds

Higher price per ounce means more value stored in compact form

Silver’s Investment Role

Functions as a hybrid asset with both monetary and industrial demand

Price often moves more sharply than gold’s in both bull markets and bear markets

Silver’s demand from manufacturing ties its price to global economy performance

More accessible entry point—investors can buy more ounces with less capital

Potential for higher percentage gains (silver surged 47% in early 2021 versus gold’s 5%)

Key Investment Considerations

Factor | Gold | Silver |

|---|---|---|

Volatility | Lower (more stable) | Higher (2-3x daily swings vs gold) |

Correlation with stocks | Lower | Higher (industrial demand linkage) |

Price per ounce | Thousands of dollars | Tens of dollars |

Storage requirements | Compact | Bulky (60x more space for same value) |

Upside potential | Moderate | Higher (with higher risk) |

Common Investment Forms

Physical bullion: Coins and bars from government mints and private refiners

ETFs: Exchange-traded funds tracking metal prices without physical ownership

Mining stocks: Shares in companies extracting gold or silver

Futures and options: Derivatives for sophisticated investors

Each form carries different costs including premiums over spot price, storage fees, insurance, management expenses, and varying tax treatments.

The Gold–Silver Ratio

The gold–silver ratio represents how many ounces of silver it takes to purchase one ounce of gold at current prices.

Historical range: From under 20:1 in some pre-modern periods to over 100:1 during market crises (like the 2020 turmoil)

Long-term average: Typically between 15:1 and 80:1

Current use: Some investors view a high ratio as a signal that silver may be undervalued relative to gold; a low ratio suggests potential relative value in gold

The ratio is just one analytical tool—not a guarantee. Consider broader economic changes, your time horizon, and risk tolerance before acting on ratio signals alone.

Price, Availability, and Storage Considerations

Cost per ounce, total budget, and logistics of holding physical metals often drive the practical choice between gold and silver. It is generally easier to sell gold quickly, as it is highly liquid and widely recognized by dealers and financial institutions.

Price Levels

Gold: Trades in thousands of dollars per ounce

Silver: Trades in tens of dollars per ounce

This makes silver far more accessible for small-scale investors asking how many ounces they can afford

Availability

Both metals are widely available from bullion dealers, banks, and major mints worldwide

Popular silver coins and bars have lower entry prices, appealing to beginning investors

Gold products require more capital but are equally accessible from reputable dealers

Storage and Weight

The density difference creates significant practical implications:

$1 million in gold: Approximately 2 cubic feet of storage

$1 million in silver: Approximately 60 cubic feet of storage

Silver requires 30x more space for equivalent value

Shipping costs are proportionally higher for silver

Premiums and Liquidity

Smaller products (1 oz coins) carry higher premiums over spot price than larger bars

Popular coins from major mints (American Eagles, Canadian Maples, Austrian Philharmonics) tend to be highly liquid globally

Silver premiums as a percentage of spot price typically exceed gold premiums

Insurance and Safety

Secure storage options range from home safes to professional vault services

Insurance costs scale with value—significant for larger holdings

Professional vaults offer better security but add ongoing fees

Gold’s compact nature makes secure storage easier and less expensive per dollar of value

Historical and Cultural Significance

Both gold and silver have shaped monetary systems and cultural symbols from antiquity through the modern era.

Gold’s Historical Status

Associated with royalty, temples, and state power in ancient Egypt, Rome, and medieval Europe

Gold standards backed major currencies through the early 20th century

Central banks continue holding gold as reserve assets today

Symbolizes ultimate achievement, immortality, and divine connection across cultures

Silver’s Role in Currency

Circulated widely among merchants and common people as everyday money

Roman denarii, Spanish pieces of eight, and 19th-century silver dollars served as trade currencies

More abundant supply made silver practical for smaller transactions

Linked to lunar symbolism, clarity, and reflection in art and literature

Bimetallic Systems

Many historical economies operated on bimetallic standards with both gold and silver serving as currency at fixed legal ratios. These systems often faced pressure as market ratios shifted away from official rates, eventually contributing to transitions toward gold-only standards.

Cultural Symbolism

Gold: Achievement, success, eternity (“gold medal,” “golden age”)

Silver: Clarity, reflection, everyday commerce (“silver screen,” “silver lining”)

Both appear throughout religious texts, literature, and art as symbols of intrinsic value

How to Decide: Gold, Silver, or Both?

Neither metal is “better” in all cases. The right choice depends entirely on your specific goals, constraints, and preferences.

When Gold May Be Preferred

Long-term wealth preservation is the primary goal

You want a crisis hedge with lower volatility

Storage space is limited

You prioritize global liquidity and recognition

Capital is sufficient for meaningful gold positions

When Silver May Be Preferred

Working with a smaller budget

Comfortable with higher price volatility

Interested in potential upside from industrial demand growth (especially solar and electronics)

Willing to manage bulkier physical holdings

Seeking larger percentage gains in bull markets

Blending Both Metals

Many investors hold both gold and silver to diversify across different demand drivers and price behaviors. Gold provides stability and crisis protection while silver offers growth potential linked to manufacturing and technology trends.

Before committing significant capital to either commodity, consider:

Your investment time horizon

Available storage options and associated costs

Your broader portfolio mix and how precious metals fit within it

Your tolerance for price volatility

The next piece of your financial strategy might include one or both of these timeless metals. Start with small positions to understand how each behaves, then adjust your allocation as your experience and confidence grow.