Medallion Fund: The World’s Most Successful Hedge Fund

In the world of finance, where beating the market consistently is considered nearly impossible, one fund has achieved what many thought was mathematically unattainable. Jim Simons launched the Medallion Fund in 1988, and since then, operated by renaissance technologies, it has generated an astonishing 39% annual net returns for over three decades, transforming it into the most successful hedge fund in history.

While warren buffett and george soros became household names through traditional investment approaches, jim simons built something entirely different at his long island strip mall headquarters. Among the best investors, including Warren Buffett's Berkshire Hathaway, the Medallion Fund stands out for its exceptional performance. Using mathematical models, machine learning, and pattern recognition, the flagship medallion fund has created more wealth per dollar invested and generated more money over time than any other investment vehicle in modern financial markets.

This legendary medallion fund represents more than just outstanding returns—it embodies a complete reimagining of how money can be made in the stock market. Notably, Jim Simons received the prestigious Oswald Veblen Prize, underscoring the mathematical excellence behind the fund. Unlike traditional funds that rely on fundamental analysis or macroeconomic insights, Medallion operates as a pure mathematical research laboratory, where brilliant mathematicians and computer scientists have solved the market through algorithmic trading and artificial intelligence. The fund's secret sauce lies in its innovative, scientifically-driven trading strategies, leveraging diverse data sources and automated execution.

Introduction to Renaissance Technologies

Renaissance Technologies stands as the most influential hedge fund in the world—period. Founded in 1982 by mathematician Jim Simons, this firm didn't just enter the hedge fund industry. It revolutionized it completely. Advanced mathematical models, data analysis, and machine learning became their weapons of choice against market complexities. Headquartered on Long Island, New York, Renaissance Technologies achieved what others only dream about—consistently crushing traditional benchmarks like the S&P 500 while redefining what's possible in quantitative trading.

The Medallion Fund represents pure excellence in financial markets. Launched by Simons and locked away from outside investors since 1993, this fund became legendary for good reason. Secrecy and exclusivity? Absolutely. But the results speak volumes—exceptional returns that make it the most coveted investment opportunity globally. Renaissance's commitment to scientific rigor and pattern recognition drives this performance. Their relentless pursuit of market inefficiencies through statistical arbitrage eliminates what others miss entirely.

Renaissance Technologies operates with a unique culture that prioritizes results over traditional finance credentials. Mathematical research and interdisciplinary collaboration drive everything they do. The firm attracts the world's most brilliant minds—mathematicians, computer scientists, speech recognition experts. Robert Mercer and Peter Brown played pivotal roles developing proprietary trading algorithms that consistently outperform. Their expertise in information theory, hidden Markov models, and machine learning keeps Renaissance ahead of the curve. Market conditions change constantly—their investment strategies adapt decisively.

The firm's approach, detailed in Gregory Zuckerman's "The Man Who Solved the Market," operates on one fundamental belief—financial markets can be decoded and systematically exploited using scientific methods. This philosophy launched Renaissance to the forefront of the quant revolution. More importantly, it inspired an entire generation of hedge funds to adopt data-driven, model-based strategies. Figures like Elwyn Berlekamp contributed sophisticated position sizing and risk management techniques. These innovations cemented Renaissance's reputation as the undisputed leader in quantitative finance.

Renaissance Technologies continues pushing boundaries that others consider impossible. Innovation drives their culture. Top talent from diverse scientific disciplines fuels their success. The firm sets benchmarks for excellence that competitors struggle to match. Their enduring legacy? The continued dominance of the Medallion Fund and profound impact on global financial market management. Renaissance didn't just succeed—they transformed how money gets managed worldwide.

What is the Medallion Fund

The Medallion Fund is renaissance technologies’ flagship hedge fund, launched in 1988 by mathematician and former code-breaker jim simons. Unlike conventional hedge funds that blend human intuition with market analysis, Medallion operates as a purely quantitative trading system that uses mathematical models and statistical arbitrage to exploit market inefficiencies.

At its core, the fund represents a radical departure from traditional wall street thinking. Rather than hiring MBA graduates or experienced traders, simons launched a systematic approach that recruited top mathematicians, physicists, and computer scientists to build automated trading systems. This scientific approach to investment strategies has produced returns that dwarf those of other funds and traditional institutional investor portfolios.

The fund’s name pays tribute to the mathematical achievements of its founders—jim simons and James Ax both won prestigious mathematical awards including medals, hence “Medallion.” This naming choice reflects the fund’s fundamental identity: a mathematical research organization that happens to make money in financial markets.

Since 1993, the fund has been closed to outside investors, operating exclusively as a retirement plan and wealth-building vehicle for renaissance employees. This unique structure allows the fund to maintain its focus on maximizing returns rather than gathering assets, a key factor in its sustained outperformance across multiple asset classes.

Today, the Medallion Fund stands as proof that markets can be systematically exploited through rigorous scientific analysis, challenging the efficient market hypothesis that dominated academic thinking for decades. Its success has sparked a quant revolution across the hedge fund industry, though none have successfully replicated its extraordinary track record.

Medallion Fund Performance and Returns

The numbers behind the Medallion Fund’s performance are staggering and almost difficult to believe. From 1988 to 2018, the fund generated gross annual returns of approximately 66%, which translates to net returns of 39% after fees—a performance that puts it in a category entirely its own among investment funds.

To understand the magnitude of this achievement, consider this comparison: $1,000 invested in the Medallion Fund in 1988 would have grown to approximately $90.1 million by 2018. The same investment in the S&P 500 would have grown to just $40 over the same time period. This represents a compound annual growth rate that significantly outperformed traditional market benchmarks by orders of magnitude.

Perhaps most remarkably, the fund has experienced only one losing year since its inception—a modest decline in 1989 during its early operational phase. This consistency is unprecedented in the hedge fund industry, where even the most successful funds typically experience multiple down years over three decades of operation.

The fund’s crisis performance has been particularly impressive. During the 2008 financial crisis, when the S&P 500 lost 37% and most hedge funds suffered significant losses, the Medallion Fund returned 82%. This performance during market stress demonstrates the fund’s market-neutral approach and its ability to profit from volatility rather than broad market direction.

More recent performance continues this trend. In 2020, during the pandemic-induced market volatility, the fund achieved returns of 76%, once again proving its ability to generate profits regardless of broader economic conditions. These returns come from trading currencies, futures, and other financial instruments using high-frequency quantitative trading strategies that operate independently of traditional market factors.

Year | Medallion Fund Return | S&P 500 Return |

|---|---|---|

2008 | 82% | -37% |

2009 | 62% | 26% |

2020 | 76% | 16% |

The fund’s Sharpe ratio—a measure of risk-adjusted returns—exceeds 2.0, which is extraordinarily high for any investment strategy operating over decades. This indicates that the fund generates its exceptional returns without taking proportionally excessive risks, a hallmark of sophisticated quantitative strategies.

History and Founding of the Medallion Fund

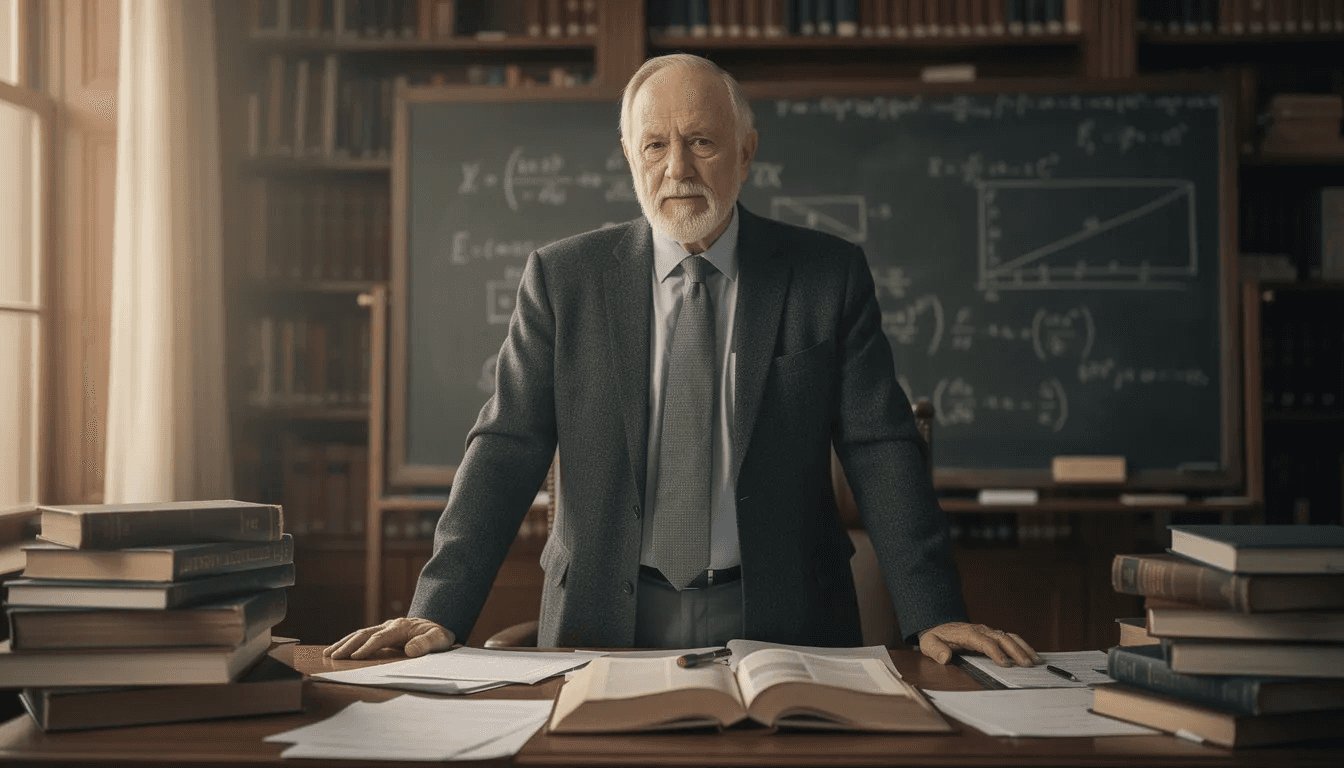

The story of the Medallion Fund begins with jim simons, a mathematician who left his position at stony brook university’s mathematics department in 1978 to pursue a career in finance. Unlike traditional wall street executives, Simons brought a purely academic approach to market analysis, viewing financial markets as complex mathematical systems that could be decoded and exploited.

Before founding renaissance technologies, Simons established Monemetrics in 1978, focusing initially on trading currencies using basic mathematical models. This early venture provided crucial learning experiences about the practical challenges of applying mathematical research to real-world trading, including issues of execution, risk management, and data quality.

In 1982, Simons renamed his firm renaissance technologies and began expanding beyond currency markets. The transformation reflected his growing conviction that mathematical models could be applied across multiple asset classes and time periods to generate consistent profits. This period saw intensive recruitment of academics and researchers rather than traditional finance professionals.

The Medallion Fund officially launched in 1988, named after the mathematical awards won by simons and mathematician James Ax. The early years were challenging, with modest returns and significant growing pains as the team refined their mathematical models and trading systems. The fund’s breakthrough came in the mid-1990s when performance accelerated dramatically.

From Monemetrics to Renaissance

The evolution from Monemetrics to renaissance technologies reflects Simons’ growing ambition and sophistication in applying scientific disciplines to financial markets. The early Monemetrics fund, starting in 1978, focused primarily on trading currencies using relatively simple mathematical models based on trend-following and mean-reversion strategies.

During this foundational period, Simons learned crucial lessons about the importance of data quality, execution speed, and risk management. The transition to renaissance technologies in 1982 marked a significant expansion of scope, as the firm began developing more sophisticated models and exploring opportunities across broader financial markets.

Key to this transformation was Simons’ decision to recruit talent from mathematical research institutions and universities rather than from wall street. This hiring philosophy brought fresh perspectives to market analysis, treating financial data as a source of patterns to be discovered through rigorous scientific methods rather than through conventional wisdom or market intuition. The Medallion Fund has a unique culture that prioritizes hiring scientists and mathematicians over traditional finance professionals, a practice that has been recognized by The New York Times for setting Renaissance Technologies apart in the industry.

The recruitment strategy emphasized finding individuals with strong backgrounds in pattern recognition, statistical analysis, and computer science—skills that proved essential for the algorithmic trading systems that would eventually power Medallion’s success. This approach distinguished renaissance from other quantitative funds and became a core competitive advantage.

Medallion Fund Investment Strategy

The Medallion Fund’s investment strategy represents a pure implementation of quantitative trading principles, relying entirely on mathematical models and pattern recognition to identify and exploit market inefficiencies. Unlike traditional hedge funds that combine fundamental analysis with quantitative inputs, Medallion operates as a fully automated trading system with minimal human intervention in daily operations.

At the heart of the fund’s approach lies statistical arbitrage—the systematic identification of price discrepancies and predictable patterns across thousands of financial instruments. The fund analyzes vast datasets to detect subtle relationships and correlations that persist over short time periods, typically holding positions for minutes to days rather than months or years.

The fund’s trading systems process up to 300,000 individual trades daily, operating across global markets in equities, futures, currencies, and other asset classes. This high-frequency approach allows Medallion to capture small price movements that, when aggregated across thousands of transactions, generate substantial profits. The fund typically uses leverage between 10x and 20x to amplify these modest individual gains.

Position sizing is determined algorithmically based on volatility, liquidity, and model confidence levels. The fund maintains market neutrality by balancing long and short positions, aiming to profit from relative price movements rather than broad market direction. This approach explains how Medallion can generate positive returns regardless of whether markets rise or fall.

Data and Technology Infrastructure

The technological foundation of the Medallion Fund represents one of the most sophisticated data operations in finance. The fund maintains petabyte-scale data warehouses containing decades of tick-by-tick price data across global markets, along with extensive alternative datasets including weather patterns, economic indicators, and social sentiment measures.

Data cleaning and validation processes are central to the fund’s success. renaissance employees spend considerable time identifying and correcting errors in historical data, ensuring that models are trained on accurate information. This attention to data quality distinguishes professional quantitative operations from amateur attempts at systematic trading.

The fund’s computing infrastructure operates on advanced clusters capable of processing millions of calculations simultaneously. These systems run ensemble models that combine thousands of individual trading signals, each contributing a small edge that compounds into substantial overall performance. The models continuously adapt and evolve as new data becomes available and market conditions change.

Execution technology focuses on minimizing latency and market impact. The fund operates co-located servers at major exchanges and uses sophisticated order routing algorithms to achieve optimal execution prices. This technological edge is particularly important for high-frequency strategies where milliseconds can determine profitability.

Machine learning algorithms continuously analyze the effectiveness of individual trading signals, automatically adjusting position sizes and removing signals that no longer provide predictive value. This adaptive approach allows the fund to maintain its edge even as markets evolve and other participants attempt to exploit similar patterns.

Key Personnel Behind Medallion’s Success

The success of the Medallion Fund stems largely from the exceptional team of scientists and mathematicians assembled by jim simons. Rather than recruiting from traditional finance backgrounds, Simons deliberately sought talent from academic institutions and research organizations, believing that mathematical rigor and scientific thinking would prove more valuable than conventional market experience.

jim simons himself brought unique qualifications to finance. Before entering the investment world, he served as a codebreaker for the National Security Agency and chaired the mathematics department at stony brook university. His academic background in geometry and his experience in cryptography provided ideal preparation for detecting hidden patterns in financial data.

elwyn berlekamp joined renaissance in 1989 and played a crucial role in developing the Kelly criterion-based position sizing systems that became central to Medallion’s risk management. Berlekamp’s expertise in information theory and mathematical optimization helped the fund maximize returns while controlling downside risk, contributing significantly to the fund’s exceptional Sharpe ratio.

robert mercer and peter brown, both speech recognition experts from IBM, transformed Medallion’s technological capabilities when they joined in the 1990s. Their expertise in machine learning and pattern recognition proved directly applicable to financial markets, where the challenge involves extracting meaningful signals from noisy price data.

Since Mercer’s retirement in 2017, peter brown has served as CEO of renaissance technologies, continuing the firm’s commitment to scientific approaches to investing. Under his leadership, the fund has maintained its performance edge while navigating increasingly competitive markets and technological changes.

The hiring philosophy at renaissance emphasizes mathematical ability over finance experience. Many employees hold PhDs in mathematics, physics, computer science, or related scientific disciplines. This creates a research environment similar to a university laboratory, where ideas are tested rigorously and successful strategies are implemented systematically.

Fee Structure and Fund Economics

The Medallion Fund operates under a fee structure that reflects both its exceptional performance and its exclusive nature. Unlike typical hedge funds that charge 2% management fees and 20% performance fees, Medallion charges 5% management fees and 44% performance fees—more than double the industry standard on both components.

This aggressive fee structure might seem prohibitive, but it becomes reasonable when considering the fund’s performance. Renaissance Technologies has demonstrated that it could theoretically charge up to 49% annually in total fees and still provide returns superior to market indices. The extraordinary gross returns of approximately 66% annually make even these high fees palatable for investors.

For renaissance employees, the high fees represent a form of profit-sharing that aligns incentives between the firm and its personnel. Since the fund is closed to outside investors, employees benefit directly from the fund’s success through their own investments, creating powerful motivation for continued innovation and performance.

The fee structure also serves a practical purpose in capacity management. By extracting substantial fees, the fund naturally limits its growth while providing renaissance with the resources necessary for continued research and development. This creates a sustainable model where high fees support the infrastructure needed to maintain performance.

Employee Retirement Benefits

In 2010, renaissance technologies took the unusual step of terminating its traditional 401(k) retirement plan and seeking Labor Department approval to allow employees to invest their retirement money directly in the Medallion Fund. This decision reflected the firm’s confidence in its flagship product and provided employees with unprecedented access to the fund’s returns.

By 2013, retirement assets invested in Medallion had grown from $86.6 million to $153 million, demonstrating the compound effect of the fund’s returns on employee wealth. This growth occurred during a period that included the 2008 financial crisis and subsequent market volatility, highlighting the fund’s defensive characteristics.

In 2014, renaissance established a new 401(k) plan that also allows Medallion investments alongside traditional options. This structure provides employees with choice while maintaining the firm’s commitment to sharing the fund’s success with its workforce. The retirement benefits represent one of the most generous packages in the financial industry.

The ability to invest retirement funds in Medallion creates extraordinary wealth-building opportunities for renaissance employees. Long-term employees who have invested consistently in the fund through their retirement accounts have accumulated substantial wealth, contributing to employee retention and firm stability.

Why Medallion is Closed to Outside Investors

The decision to close the Medallion Fund to outside investors in 1993 reflects both capacity constraints and strategic considerations that distinguish it from other hedge funds. Unlike funds that seek to maximize assets under management, renaissance technologies recognized that the quantitative strategies underlying Medallion’s success operate within finite capacity limits.

The fund’s high-frequency, statistical arbitrage approach depends on exploiting small price inefficiencies that would be arbitraged away if trading volumes became too large. By keeping the fund’s assets capped near $10 billion and limiting access to renaissance employees and their families, the firm preserves the market conditions that enable its strategies to remain profitable.

Between 1993 and 2005, renaissance systematically returned all external investor capital, ensuring that the fund could operate exclusively for employee benefit. This process required significant capital expenditure but eliminated potential conflicts between maximizing returns for insiders versus managing external investor relations and liquidity needs.

The closed structure also provides operational advantages. Without external investors demanding transparency or specific reporting, the fund can focus entirely on performance optimization. This secrecy helps protect the proprietary models and strategies that form the basis of Medallion’s competitive advantage in financial markets.

The contrast with renaissance institutional equities fund (RIEF), which is available to outside investors but has generated much lower returns, illustrates the capacity constraints faced by quantitative strategies. While RIEF manages substantially more assets, its returns are more modest, suggesting that the most profitable opportunities are indeed limited in scale.

This capacity discipline represents a fundamental difference in philosophy from most asset management firms. Rather than prioritizing growth in assets under management, renaissance has optimized for returns per dollar invested, creating extraordinary wealth for insiders while maintaining the fund’s performance edge over time.

Controversies and Investigations

Despite its investment success, renaissance technologies and the Medallion Fund have faced significant scrutiny regarding tax strategies and regulatory compliance. In 2014, the IRS launched an investigation into the firm’s use of complex derivatives structures that allegedly converted short-term trading profits into long-term capital gains, potentially saving hundreds of millions in taxes.

The investigation focused on basket options provided by Bank of America and Deutsche Bank that allowed renaissance to trade through these structures while claiming long-term capital gains treatment for what were essentially short-term trading profits. These arrangements potentially reduced the effective tax rate on Medallion’s returns from ordinary income rates to lower capital gains rates.

In 2021, jim simons and robert mercer reached a settlement with the IRS involving potential payments of up to $7 billion, including interest and penalties, related to these tax strategies. The settlement represents one of the largest tax disputes in hedge fund history and highlights the aggressive tax optimization strategies employed by the firm.

Beyond tax issues, key renaissance personnel have been involved in political controversies. robert mercer’s political activities and funding of conservative causes drew criticism and contributed to his decision to step back from leadership roles at the firm. These controversies created reputational challenges despite the fund’s investment success.

The firm has also faced scrutiny over its hiring and employment practices, particularly regarding non-compete agreements and intellectual property protection. The secretive nature of renaissance’s operations has led to disputes when employees leave to join competitors, highlighting the tension between protecting trade secrets and employee mobility.

Despite these controversies, the Medallion Fund’s investment performance has remained strong, suggesting that regulatory and tax issues have not fundamentally impacted the underlying trading strategies. However, these incidents illustrate the complex regulatory environment faced by sophisticated hedge funds operating at the frontiers of financial innovation.

The Medallion Fund’s Legacy and Impact

The Medallion Fund’s success has fundamentally transformed the hedge fund industry and broader financial markets, inspiring a generation of quantitative funds and changing how institutional investors approach portfolio construction. The fund’s proof that mathematical models can consistently generate superior returns has attracted billions of dollars into quantitative trading strategies across wall street.

The fund’s influence extends beyond performance numbers to hiring practices across finance. simons’ strategy of recruiting brilliant mathematicians, physicists, and computer scientists rather than traditional MBA graduates has been widely copied, leading to increased competition for technical talent and higher compensation for quantitative professionals.

Many of the algorithmic trading techniques and machine learning approaches pioneered at renaissance have become standard practice across the industry. While no other fund has replicated Medallion’s exact success, the overall growth of quantitative trading reflects the broader acceptance of systematic, model-driven approaches to investing.

The fund’s market-neutral approach and crisis performance have also influenced institutional investor thinking about portfolio diversification. Many large investors now allocate portions of their portfolios to quantitative strategies specifically because of their low correlation to traditional asset classes, a lesson learned from observing Medallion’s consistent performance.

Following jim simons’ death in 2024, peter brown has continued leading renaissance technologies with the same scientific approach and commitment to secrecy that characterized the simons era. The seamless transition suggests that the fund’s success depends on institutional knowledge and systematic processes rather than individual genius.

Lessons for Modern Finance

The Medallion Fund demonstrates several important principles that have implications for broader investment practice. First, it proves that financial markets contain persistent inefficiencies that can be systematically exploited by sufficiently sophisticated analysis, challenging the efficient market hypothesis that dominated academic finance for decades.

Second, the fund illustrates the importance of interdisciplinary approaches to complex problems. By applying techniques from mathematics, physics, computer science, and information theory to financial markets, renaissance created insights unavailable to traditional analysts focused solely on economic and business fundamentals.

Third, Medallion’s success highlights the value of long-term data collection and scientific rigor in investment research. The fund’s extensive historical databases and careful backtesting procedures enabled the discovery of subtle patterns that shorter-term analysis might miss, providing sustainable competitive advantages.

Finally, the fund demonstrates that systematic, automated approaches can remove human behavioral biases that often undermine investment performance. By eliminating emotional decision-making and maintaining discipline during market stress, algorithmic systems can exploit the very behavioral patterns that cause other market participants to make suboptimal decisions.

The ongoing secrecy surrounding renaissance’s specific methodologies, enforced through strict non-disclosure agreements and intellectual property protection, ensures that these lessons remain largely theoretical for external observers. However, the fund’s existence continues to inspire innovation in quantitative finance and serves as a benchmark for what is possible when mathematical research meets financial markets.

The Medallion Fund stands as the ultimate proof that markets can be systematically beaten through scientific rigor, technological innovation, and mathematical sophistication. While its exact methods remain secret, its success has revolutionized finance and continues to influence how money is managed in the modern world.